Page 10 - Winsight 2021 Benefit Guide

P. 10

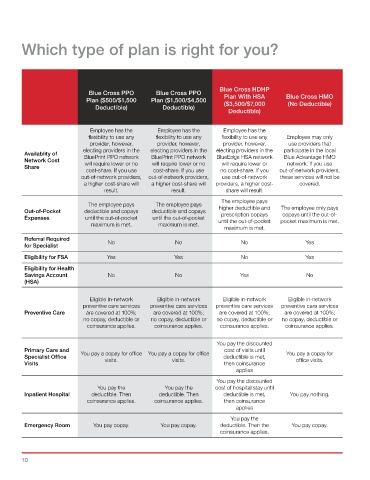

Which type of plan is right for you?

Blue Cross HDHP

Blue Cross PPO Blue Cross PPO

Plan ($500/$1,500 Plan ($1,500/$4,500 Plan With HSA Blue Cross HMO

(No Deductible)

($3,500/$7,000

Deductible) Deductible)

Deductible)

Employee has the Employee has the Employee has the

flexibility to use any flexibility to use any flexibility to use any Employee may only

provider, however, provider, however, provider, however, use providers that

electing providers in the electing providers in the electing providers in the participate in the local

Availablity of BluePrint PPO network BlueEdge HSA network Blue Advantage HMO

Network Cost BluePrint PPO network will require lower or no will require lower or network. If you use

Share will require lower or no

cost-share. If you use cost-share. If you use no cost-share. If you out-of-network providers,

out-of-network providers, out-of-network providers, use out-of-network these services will not be

a higher cost-share will a higher cost-share will providers, a higher cost- covered.

result. result. share will result.

The employee pays

The employee pays The employee pays higher deductible and The employee only pays

Out-of-Pocket deductible and copays deductible and copays prescription copays copays until the out-of-

Expenses until the out-of-pocket until the out-of-pocket until the out-of-pocket pocket maximum is met.

maximum is met. maximum is met.

maximum is met.

Referral Required No No No Yes

for Specialist

Eligibility for FSA Yes Yes No Yes

Eligibility for Health

Savings Account No No Yes No

(HSA)

Eligible in-network Eligible in-network Eligible in-network Eligible in-network

preventive care services preventive care services preventive care services preventive care services

Preventive Care are covered at 100%; are covered at 100%; are covered at 100%; are covered at 100%;

no copay, deductible or no copay, deductible or no copay, deductible or no copay, deductible or

coinsurance applies. coinsurance applies. coinsurance applies. coinsurance applies.

You pay the discounted

Primary Care and cost of visits until

Specialist Office You pay a copay for office You pay a copay for office deductible is met, You pay a copay for

Visits visits. visits. then coinsurance office visits.

applies

You pay the discounted

You pay the You pay the cost of hospital stay until

Inpatient Hospital deductible. Then deductible. Then deductible is met, You pay nothing.

coinsurance applies. coinsurance applies. then coinsurance

applies

You pay the

Emergency Room You pay copay. You pay copay. deductible. Then the You pay copay.

coinsurance applies.

10