Page 89 - Amata-one-report2020-en

P. 89

BUSINESS OPERATION AND OPERATING RESULTS CORPORATE GOVERNANCE FINANCIAL STATEMENTS ENCLOSURES

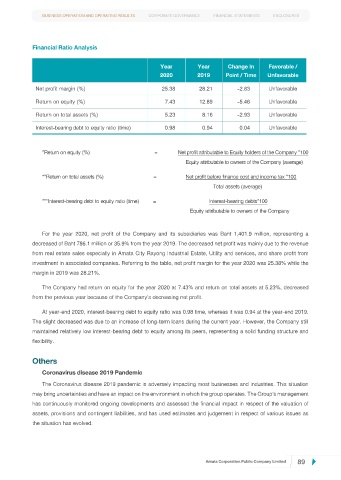

Financial Ratio Analysis

Year Year Change In Favorable /

2020 2019 Point / Time Unfavorable

Net profit margin (%) 25.38 28.21 -2.83 Unfavorable

Return on equity (%) 7.43 12.89 -5.46 Unfavorable

Return on total assets (%) 5.23 8.16 -2.93 Unfavorable

Interest-bearing debt to equity ratio (time) 0.98 0.94 0.04 Unfavorable

*Return on equity (%) = Net profit attributable to Equity holders of the Company *100

Equity attributable to owners of the Company (average)

**Return on total assets (%) = Net profit before finance cost and income tax *100

Total assets (average)

***Interest-bearing debt to equity ratio (time) = Interest-bearing debts*100

Equity attributable to owners of the Company

For the year 2020, net profit of the Company and its subsidiaries was Baht 1,401.9 million, representing a

decreased of Baht 786.1 million or 35.9% from the year 2019. The decreased net profit was mainly due to the revenue

from real estate sales especially in Amata City Rayong Industrial Estate, Utility and services, and share profit from

investment in associated companies. Referring to the table, net profit margin for the year 2020 was 25.38% while the

margin in 2019 was 28.21%.

The Company had return on equity for the year 2020 at 7.43% and return on total assets at 5.23%, decreased

from the previous year because of the Company’s decreasing net profit.

At year-end 2020, interest-bearing debt to equity ratio was 0.98 time, whereas it was 0.94 at the year-end 2019.

The slight decreased was due to an increase of long-term loans during the current year. However, the Company still

maintained relatively low interest-bearing debt to equity among its peers, representing a solid funding structure and

flexibility.

Others

Coronavirus disease 2019 Pandemic

The Coronavirus disease 2019 pandemic is adversely impacting most businesses and industries. This situation

may bring uncertainties and have an impact on the environment in which the group operates. The Group’s management

has continuously monitored ongoing developments and assessed the financial impact in respect of the valuation of

assets, provisions and contingent liabilities, and has used estimates and judgement in respect of various issues as

the situation has evolved.

Amata Corporation Public Company Limited 89