Page 116 - Employee Handbook

P. 116

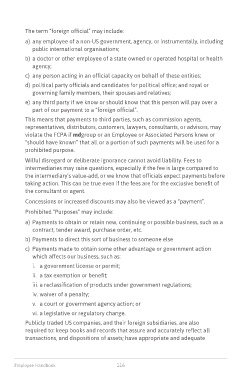

The term “foreign official” may include:

a) any employee of a non-US government, agency, or instrumentally, including

public international organisations;

b) a doctor or other employee of a state owned or operated hospital or health

agency;

c) any person acting in an official capacity on behalf of these entities;

d) political party officials and candidates for political office; and royal or

governing family members, their spouses and relatives;

e) any third party if we know or should know that this person will pay over a

part of our payment to a “foreign official”.

This means that payments to third parties, such as commission agents,

representatives, distributors, customers, lawyers, consultants, or advisors, may

violate the FCPA if mdgroup or an Employee or Associated Persons knew or

“should have known” that all or a portion of such payments will be used for a

prohibited purpose.

Wilful disregard or deliberate ignorance cannot avoid liability. Fees to

intermediaries may raise questions, especially if the fee is large compared to

the intermediary’s value-add, or we know that officials expect payments before

taking action. This can be true even if the fees are for the exclusive benefit of

the consultant or agent.

Concessions or increased discounts may also be viewed as a “payment”.

Prohibited “Purposes” may include:

a) Payments to obtain or retain new, continuing or possible business, such as a

contract, tender award, purchase order, etc.

b) Payments to direct this sort of business to someone else

c) Payments made to obtain some other advantage or government action

which affects our business, such as:

i. a government license or permit;

ii. a tax exemption or benefit;

iii. a reclassification of products under government regulations;

iv. waiver of a penalty;

v. a court or government agency action; or

vi. a legislative or regulatory change.

Publicly traded US companies, and their foreign subsidiaries, are also

required to: keep books and records that assure and accurately reflect all

transactions, and dispositions of assets; have appropriate and adequate

Employee Handbook 116