Page 455 - Fundamentals of Management Myths Debunked (2017)_Flat

P. 455

KeePing traCK:

What gets Controlled?

Countless activities are taking place in

different organizational locations and

functional areas!

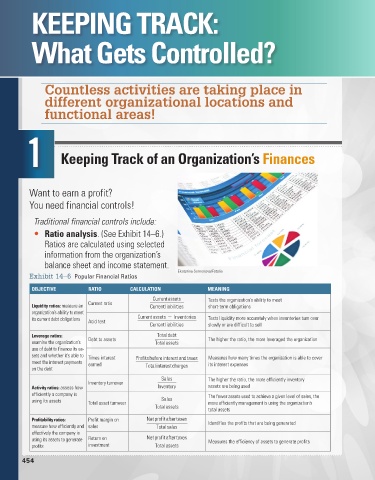

1 Keeping track of an organization’s Finances

Want to earn a profit?

You need financial controls!

Traditional financial controls include:

• ratio analysis. (See Exhibit 14–6.)

Ratios are calculated using selected

information from the organization’s

balance sheet and income statement.

Ekaterina Semenova/Fotolia

Exhibit 14–6 Popular Financial Ratios

objeCtive ratio CalCulation Meaning

Current assets Tests the organization’s ability to meet

liquidity ratios: measure an Current ratio Current liabilities short-term obligations

organization’s ability to meet

its current debt obligations Acid test Current assets - Inventories Tests liquidity more accurately when inventories turn over

Current liabilities slowly or are difficult to sell

leverage ratios: Debt to assets Total debt The higher the ratio, the more leveraged the organization

examine the organization’s Total assets

use of debt to finance its as-

sets and whether it’s able to Times interest Profits before interest and taxes Measures how many times the organization is able to cover

meet the interest payments earned its interest expenses

on the debt Total interest charges

Sales The higher the ratio, the more efficiently inventory

Inventory turnover

activity ratios: assess how Inventory assets are being used

efficiently a company is The fewer assets used to achieve a given level of sales, the

using its assets Total asset turnover Sales more efficiently management is using the organization’s

Total assets total assets

Profitability ratios: Profit margin on Net profit after taxes

measure how efficiently and sales Total sales Identifies the profits that are being generated

effectively the company is

using its assets to generate Return on Net profit after taxes Measures the efficiency of assets to generate profits

profits investment Total assets

454