Page 181 - Krugmans Economics for AP Text Book_Neat

P. 181

inflation rate discourages people from entering into any form of long -term contract.

Disinflation is the process of bringing the

This is an additional cost of high inflation, because high rates of inflation are usually

inflation rate down.

unpredictable, too. In countries with high and uncertain inflation, long - term loans are

rare. This, in turn, makes it difficult for people to commit to long -term investments.

One last point: unexpected deflation—a surprise fall in the price level—creates win-

ners and losers, too. Between 1929 and 1933, as the U.S. economy plunged into the

Great Depression, the price level fell by 35%. This meant that debtors, including many

farmers and homeowners, saw a sharp rise in the real value of their debts, which led to

widespread bankruptcy and helped create a banking crisis, as lenders found their cus- Section 3 Measurement of Economic Performance

tomers unable to pay back their loans.

Inflation Is Easy; Disinflation Is Hard

There is not much evidence that a rise in the inflation rate from, say, 2% to 5% would do a

great deal of harm to the economy. Still, policy makers generally move forcefully to bring

inflation back down when it creeps above 2% or 3%. Why? Because experience shows that

bringing the inflation rate down—a process called disinflation—is very difficult and

costly once a higher rate of inflation has become well established in the economy.

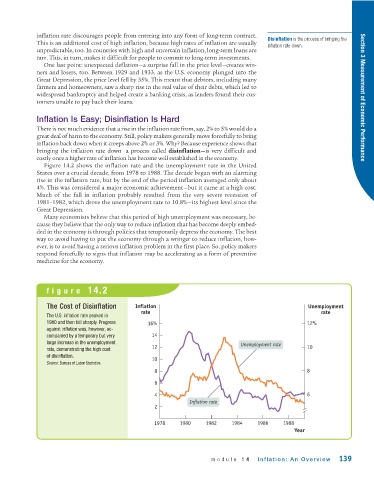

Figure 14.2 shows the inflation rate and the unemployment rate in the United

States over a crucial decade, from 1978 to 1988. The decade began with an alarming

rise in the inflation rate, but by the end of the period inflation averaged only about

4%. This was considered a major economic achievement—but it came at a high cost.

Much of the fall in inflation probably resulted from the very severe recession of

1981–1982, which drove the unemployment rate to 10.8%—its highest level since the

Great Depression.

Many economists believe that this period of high unemployment was necessary, be-

cause they believe that the only way to reduce inflation that has become deeply embed-

ded in the economy is through policies that temporarily depress the economy. The best

way to avoid having to put the economy through a wringer to reduce inflation, how-

ever, is to avoid having a serious inflation problem in the first place. So, policy makers

respond forcefully to signs that inflation may be accelerating as a form of preventive

medicine for the economy.

figure 14.2

The Cost of Disinflation Inflation Unemployment

rate rate

The U.S. inflation rate peaked in

1980 and then fell sharply. Progress 16% 12%

against inflation was, however, ac-

companied by a temporary but very 14

large increase in the unemployment Unemployment rate

12 10

rate, demonstrating the high cost

of disinflation.

10

Source: Bureau of Labor Statistics.

8 8

6

4 6

Inflation rate

2

1978 1980 1982 1984 1986 1988

Year

module 14 Inflation: An Overview 139