Page 374 - Krugmans Economics for AP Text Book_Neat

P. 374

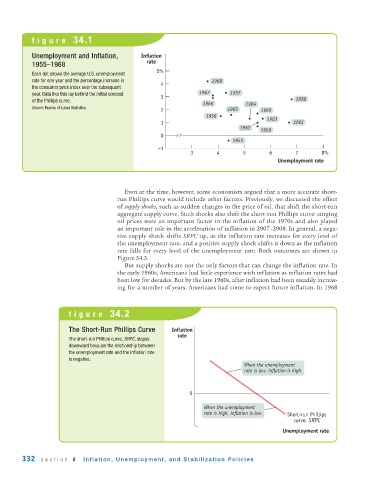

figure 34.1

Unemployment and Inflation, Inflation

rate

1955–1968

5%

Each dot shows the average U.S. unemployment

rate for one year and the percentage increase in 4 1968

the consumer price index over the subsequent

year. Data like this lay behind the initial concept 3 1967 1957

of the Phillips curve. 1958

1966 1964

Source: Bureau of Labor Statistics. 2 1965 1960

1956

1 1963 1961

1962

1959

0

1955

–1

3 4 5 6 7 8%

Unemployment rate

Even at the time, however, some economists argued that a more accurate short -

run Phillips curve would include other factors. Previously, we discussed the effect

of supply shocks, such as sudden changes in the price of oil, that shift the short - run

aggregate supply curve. Such shocks also shift the short - run Phillips curve: surging

oil prices were an important factor in the inflation of the 1970s and also played

an important role in the acceleration of inflation in 2007–2008. In general, a nega-

tive supply shock shifts SRPC up, as the inflation rate increases for every level of

the unemployment rate, and a positive supply shock shifts it down as the inflation

rate falls for every level of the unemployment rate. Both outcomes are shown in

Figure 34.3.

But supply shocks are not the only factors that can change the inflation rate. In

the early 1960s, Americans had little experience with inflation as inflation rates had

been low for decades. But by the late 1960s, after inflation had been steadily increas-

ing for a number of years, Americans had come to expect future inflation. In 1968

figure 34.2

The Short -Run Phillips Curve Inflation

rate

The short -run Phillips curve, SRPC, slopes

downward because the relationship between

the unemployment rate and the inflation rate

is negative.

When the unemployment

rate is low, inflation is high.

0

When the unemployment

rate is high, inflation is low. Short-run Phillips

curve, SRPC

Unemployment rate

332 section 6 Inflation, Unemployment, and Stabilization Policies