Page 376 - Krugmans Economics for AP Text Book_Neat

P. 376

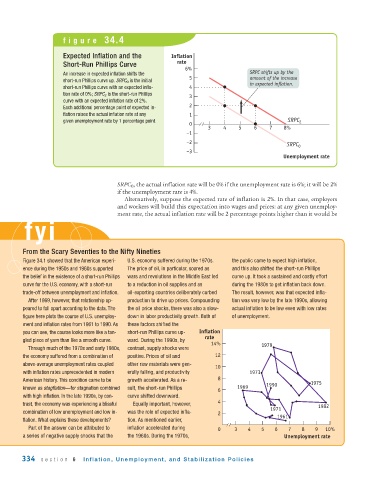

figure 34.4

Expected Inflation and the Inflation

Short - Run Phillips Curve rate

6%

An increase in expected inflation shifts the SRPC shifts up by the

5 amount of the increase

short -run Phillips curve up. SRPC 0 is the initial

short - run Phillips curve with an expected infla- 4 in expected inflation.

tion rate of 0%; SRPC 2 is the short -run Phillips

3

curve with an expected inflation rate of 2%.

2

Each additional percentage point of expected in-

flation raises the actual inflation rate at any 1

given unemployment rate by 1 percentage point. SRPC 2

0

3 4 5 6 7 8%

–1

–2

SRPC 0

–3

Unemployment rate

SRPC 0 , the actual inflation rate will be 0% if the unemployment rate is 6%; it will be 2%

if the unemployment rate is 4%.

Alternatively, suppose the expected rate of inflation is 2%. In that case, employers

and workers will build this expectation into wages and prices: at any given unemploy-

ment rate, the actual inflation rate will be 2 percentage points higher than it would be

fyi

From the Scary Seventies to the Nifty Nineties

Figure 34.1 showed that the American experi- U.S. economy suffered during the 1970s. the public came to expect high inflation,

ence during the 1950s and 1960s supported The price of oil, in particular, soared as and this also shifted the short-run Phillips

the belief in the existence of a short-run Phillips wars and revolutions in the Middle East led curve up. It took a sustained and costly effort

curve for the U.S. economy, with a short -run to a reduction in oil supplies and as during the 1980s to get inflation back down.

trade-off between unemployment and inflation. oil-exporting countries deliberately curbed The result, however, was that expected infla-

After 1969, however, that relationship ap- production to drive up prices. Compounding tion was very low by the late 1990s, allowing

peared to fall apart according to the data. The the oil price shocks, there was also a slow- actual inflation to be low even with low rates

figure here plots the course of U.S. unemploy- down in labor productivity growth. Both of of unemployment.

ment and inflation rates from 1961 to 1990. As these factors shifted the

you can see, the course looks more like a tan- short-run Phillips curve up- Inflation

rate

gled piece of yarn than like a smooth curve. ward. During the 1990s, by

14% 1979

Through much of the 1970s and early 1980s, contrast, supply shocks were

the economy suffered from a combination of positive. Prices of oil and 12

above - average unemployment rates coupled other raw materials were gen-

10

with inflation rates unprecedented in modern erally falling, and productivity 1973

American history. This condition came to be growth accelerated. As a re- 8

1990 1975

known as stagflation—for stagnation combined sult, the short-run Phillips 1969

6

with high inflation. In the late 1990s, by con- curve shifted downward.

4

trast, the economy was experiencing a blissful Equally important, however, 1982

1971

combination of low unemployment and low in- was the role of expected infla- 2

flation. What explains these developments? tion. As mentioned earlier, 1961

Part of the answer can be attributed to inflation accelerated during 0 3 4 5 6 7 8 9 10%

a series of negative supply shocks that the the 1960s. During the 1970s, Unemployment rate

334 section 6 Inflation, Unemployment, and Stabilization Policies