Page 11 - Westmounter_FallWinter2020_Digitalv2[Oct2_2020]

P. 11

The Westmounter

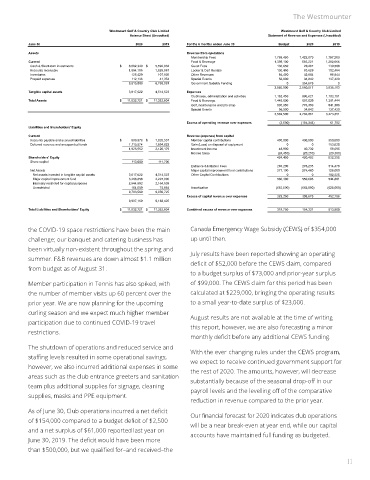

by the numbers: June 30 Westmount Golf & Country Club Limited For the 6 months ended June 30 Statement of Revenue and Expenses (Unaudited)

Westmount Golf & Country Club Limited

Balance Sheet (Unaudited)

2020

Budget

2019

2020

2019

Assets Revenue from operations 1,788,450 1,422,079 1,787,209

six-month Current $ 6,682,349 $ 5,592,834 Food & Beverage 1,399,100 583,221 1,282,666

Membership Fees

Guest Fees

130,650

Cash & Short-term investments

139,500

29,267

Locker & Cart Rentals

1,025,987

1,094,185

Accounts receivable

83,629

102,464

100,450

85,844

126,429

42,804

Inventories

107,905

Prepaid expenses 8,015,099 6,768,081 Other Revenues 84,450 0 354,675 137,420 0

Special Events

56,900

34,842

41,354

112,136

Government Subsidy Funding

financial update Tangible capital assets $ 11,832,721 $ 11,282,604 Expenses 3,560,000 2,550,517 3,535,103

3,817,622

4,514,523

996,621

1,163,450

Clubhouse, administration and activities

1,103,101

Food & Beverage

1,391,444

Total Assets

897,039

1,446,800

Golf, maintenance and pro shop

56,900

Special Events 895,350 776,359 841,386

34,842

137,420

3,562,500 2,704,861 3,473,351

Excess of operating revenue over expenses (2,500) (154,344) 61,752

JIM HARPER, TREASURER AND DAVID WHITE, CONTROLLER Liabilities and Shareholders' Equity

Current Revenue (expenes) from capital

Accounts payable and accrued liabilities $ 809,978 $ 1,025,557 Member capital contributions 400,000 400,000 350,000

Deferred revenue and unexpended funds 1,115,574 1,094,622 Gain (Loss) on disposal of equipment 0 0 153,620

48,900

40,732

58,095

We are pleased to report on the Club’s six-month for individuals was established, we did end up placing 1,925,552 2,120,179 Investment income (24,450) (20,250) (29,360)

Income taxes

financial results and our financial forecast for the rest 56 of our staff on temporary layoff, which was about Shareholders' Equity 113,600 111,700 424,450 420,482 532,355

Share capital

Entrance & Initiation Fees 283,200 276,233 314,476

of year. Included here are the unaudited Balance Sheet two thirds of our active work force at that point in the Net Assets Major capital improvement fund contributions 277,100 274,460 128,000

Net assets invested in tangible capital assets 3,817,622 4,514,523 Other Capital Contributions 0 0 102,325

and Statement of Revenue and Expenses as of June season. Of those that remained on active payroll, many Major capital improvement fund 3,266,856 2,297,000 560,300 550,693 544,801

Internally restricted for capital purposes 2,544,582 2,164,538

74,664

164,509

30, 2020 with budget and prior year comparisons. The were reassigned to other departments where the work Unrestricted 9,793,569 9,050,725 Amortization (662,500) (662,500) (625,000)

Audit & Finance Committee has been hard at work was a deemed necessity such as golf course property 9,907,169 9,162,425 Excess of capital revenue over expenses 322,250 308,675 452,156

assisting Club Management to navigate through these maintenance. Their efforts were significant in prepping Total Liabilities and Shareholders' Equity $ 11,832,721 $ 11,282,604 Combined excess of revenue over expenses 319,750 154,331 513,909

challenging times. While COVID-19 has significantly the golf course for its eventual opening. We are

impacted our operations and our results, thankfully the pleased to report that all staff on layoff were eventually the COVID-19 space restrictions have been the main Canada Emergency Wage Subsidy (CEWS) of $354,000

Club was in a strong financial position to weather the recalled. challenge; our banquet and catering business has up until then.

storm. been virtually non-existent throughout the spring and

Following the Ontario government announcement July results have been reported showing an operating

Westmount had no choice but to follow the of Phase 1 of the recovery plan, we opened the golf summer. F&B revenues are down almost $1.1 million deficit of $52,000 before the CEWS claim, compared

government emergency mandate and shutdown all course on May 16. This was likely the latest opening from budget as of August 31. to a budget surplus of $73,000 and prior-year surplus

Club operations effective March 15, as everyone’s date in Westmount’s history, but remember we only Member participation in Tennis has also spiked, with of $99,000. The CEWS claim for this period has been

health and safety was the primary concern. With no had three or four decent weather days up until that the number of member visits up 60 percent over the calculated at $229,000, bringing the operating results

idea how long the shut down would last—and not time, including snow the entire previous Mother’s Day prior year. We are now planning for the upcoming to a small year-to-date surplus of $23,000.

knowing the full extent of government wage subsidy weekend. Upon opening, the condition of the golf curling season and we expect much higher member

funding that would later become available—we course was spectacular and demand for play was high. participation due to continued COVID-19 travel August results are not available at the time of writing

developed three separate financial forecasts to plan As of August 31, overall rounds played are almost 9 restrictions. this report, however, we are also forecasting a minor

for the various scenarios we might face. With these percent higher than the prior year at that point. Year to monthly deficit before any additional CEWS funding.

projections, Westmount’s Board of Directors decided to date cart rentals are right on budget, however we are The shutdown of operations and reduced service and With the ever-changing rules under the CEWS program,

credit all member accounts 50 percent of the monthly down almost 50 percent in guest fee revenue, so net staffing levels resulted in some operational savings, we expect to receive continued government support for

fee installment for the months of March and April. In golf revenues are down $163,000 from budget as of however, we also incurred additional expenses in some the rest of 2020. The amounts, however, will decrease

total, the credits amounted to 1/12th of our annual fee August 31. areas such as the club entrance greeters and sanitation substantially because of the seasonal drop-off in our

revenue, with a financial impact of just over $400,000. team plus additional supplies for signage, cleaning payroll levels and the levelling off of the comparative

Early on during the pandemic shutdown, our Food & supplies, masks and PPE equipment.

The Board also felt the Club needed to look after Team Beverage (F&B) Team introduced the new pantry and reduction in revenue compared to the prior year.

Westmount, as they continually look after our members, take-out food service, which proved to be popular As of June 30, Club operations incurred a net deficit Our financial forecast for 2020 indicates club operations

and made the decision to keep our entire staff on and helpful to our members. F&B Service has been in of $154,000 compared to a budget deficit of $2,500 will be a near break-even at year end, while our capital

payroll for a three-week period. When the emergency high demand since the patio reopening in mid-June and a net surplus of $61,000 reported last year on accounts have maintained full funding as budgeted.

order was extended into April and government support and indoor dining reopening in mid-July, however June 30, 2019. The deficit would have been more

than $500,000, but we qualified for–and received–the

10 11