Page 137 - UUBO Deal Academy 2020 - Materials

P. 137

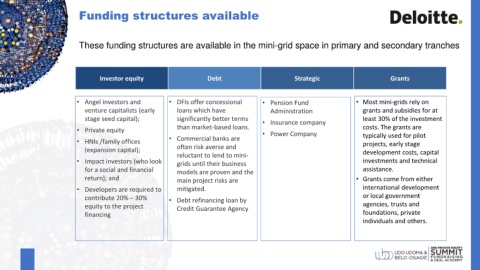

Funding structures available

These funding structures are available in the mini-grid space in primary and secondary tranches

Investor equity Debt Strategic Grants

• Angel investors and • DFIs offer concessional • Pension Fund • Most mini-grids rely on

venture capitalists (early loans which have Administration grants and subsidies for at

stage seed capital); significantly better terms • Insurance company least 30% of the investment

than market-based loans. costs. The grants are

• Private equity • Power Company

• Commercial banks are typically used for pilot

• HNIs /family offices projects, early stage

often risk averse and

(expansion capital); development costs, capital

reluctant to lend to mini-

• Impact investors (who look grids until their business investments and technical

for a social and financial models are proven and the assistance.

return); and main project risks are • Grants come from either

• Developers are required to mitigated. international development

contribute 20% – 30% • Debt refinancing loan by or local government

equity to the project Credit Guarantee Agency agencies, trusts and

financing foundations, private

individuals and others.

01