Page 138 - UUBO Deal Academy 2020 - Materials

P. 138

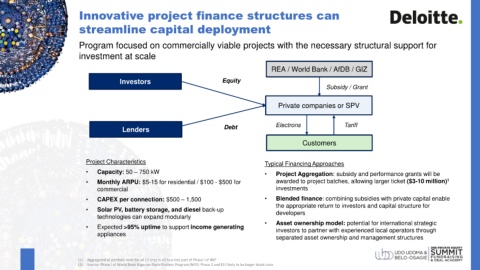

Innovative project finance structures can

streamline capital deployment

Program focused on commercially viable projects with the necessary structural support for

investment at scale

REA / World Bank / AfDB / GIZ

Investors Equity

Subsidy / Grant

Private companies or SPV

Lenders Debt Electrons Tariff

Customers

Project Characteristics Typical Financing Approaches

• Capacity: 50 – 750 kW • Project Aggregation: subsidy and performance grants will be

• Monthly ARPU: $5-15 for residential / $100 - $500 for awarded to project batches, allowing larger ticket ($3-10 million) 1

commercial investments

• CAPEX per connection: $500 – 1,500 • Blended finance: combining subsidies with private capital enable

the appropriate return to investors and capital structure for

• Solar PV, battery storage, and diesel back-up developers

technologies can expand modularly

• Asset ownership model: potential for international strategic

• Expected >95% uptime to support income generating investors to partner with experienced local operators through

appliances

separated asset ownership and management structures

01

(1) Aggregated at portfolio level for all 57 sites in all four lots part of Phase I of NEP

(2) Source: Phase I of World Bank Nigerian Electrification Program (NEP). Phase 2 and EEI likely to be larger ticket sizes