Page 123 - Demo

P. 123

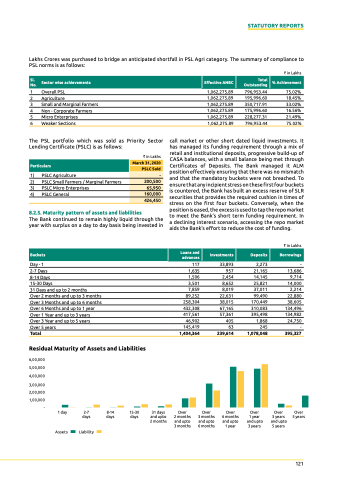

Lakhs Crores was purchased to bridge an anticipated shortfall in PSL Agri category. The summary of compliance to PSL norms is as follows:

STATUTORY REPORTS

sl. no.

sector wise achievements

effective anbc

total outstanding

% achievement

1 Overall PSL

2 Agriculture

3 Small and Marginal Farmers

4 Non - Corporate Farmers

5 Micro Enterprises

6 Weaker Sections

The PSL portfolio which was sold as Priority Sector lending Certificate (pSlC) is as follows:

1,062,275.89

1,062,275.89

1,062,275.89

1,062,275.89

1,062,275.89

1,062,275.89

796,953.44

195,996.60

350,717.91

175,996.60

228,277.31

796,953.44

` in Lakhs

75.02%

18.45%

33.02%

16.56%

21.49%

75.02%

` in Lakhs

The Bank continued to remain highly liquid through the year with surplus on a day to day basis being invested in

Day - 1 2-7 Days

8-14 Days

15-30 Days

31 Days and up to 2 months

Over 2 months and up to 3 months

Over 3 Months and up to 6 months

Over 6 Months and up to 1 year

Over 1 Year and up to 3 years

Over 3 Year and up to 5 years

Over 5 years

call market or other short dated liquid investments. It has managed its funding requirement through a mix of retail and institutional deposits, progressive build-up of CASA balances, with a small balance being met through Certificates of Deposits. the Bank managed it AlM position effectively ensuring that there was no mismatch and that the mandatory buckets were not breached. To ensure that any incipient stress on these first four buckets is countered, the Bank has built an excess reserve of SLR securities that provides the required cushion in times of stress on the first four buckets. Conversely, when the position is eased, the excess is used to tap the repo market to meet the Bank’s short term funding requirement. In a declining interest scenario, accessing the repo market aids the Bank’s effort to reduce the cost of funding.

Particulars

1) PSLC Agriculture

2) PSLC Small Farmers / Marginal Farmers

3) PSLC Micro Enterprises

4) PSLC General

8.2.5. Maturity pattern of assets and liabilities

buckets

Loans and advances

investments

deposits

borrowings

6,00,000 5,00,000 4,00,000 3,00,000 2,00,000

1,00,000 -

March 31, 2020

PsLc sold

-

200,500

65,950

160,000

426,450

117

1,635

1,506

3,501

7,859

89,252

258,304

432,308

417,561

46,902

145,419

33,893

957

2,454

8,652

8,019

22,631

38,015

67,165

57,361

405

63

239,614

2,273

21,165

14,145

25,821

37,011

99,490

170,449

310,083

395,498

1,868

245

1,078,048

` in Lakhs

-

13,686

9,714

14,000

2,214

22,880

38,605

134,496

134,982

24,750

-

395,327

total 1,404,364

residual Maturity of assets and Liabilities

1 day

Assets

2-7 8-14 days days

Liability

15-30 31 days days and upto 2 months

Over

2 months and upto 3 months

Over

3 months and upto 6 months

Over

6 months and upto 1 year

Over

1 year and upto 3 years

Over

3 years and upto 5 years

Over 5 years

121