Page 264 - Demo

P. 264

Notes to financial statements

for the year ended March 31, 2020

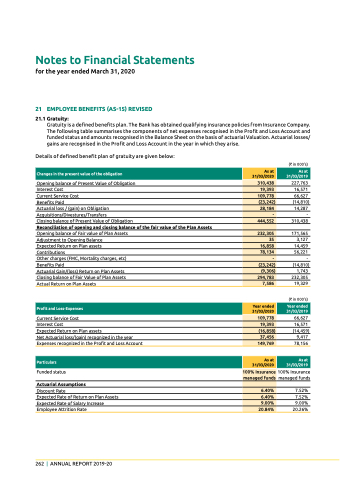

21 eMPLOyee beNefITs (As-15) ReVIsed

21.1 gratuity:

Gratuity is a defined benefits plan. the Bank has obtained qualifying insurance policies from Insurance Company. the following table summarises the components of net expenses recognised in the profit and loss Account and funded status and amounts recognised in the Balance Sheet on the basis of actuarial Valuation. Actuarial losses/ gains are recognised in the profit and loss Account in the year in which they arise.

Details of defined benefit plan of gratuity are given below:

opening balance of present Value of obligation Interest Cost

Current Service Cost

Benefits paid

Actuarial loss / (gain) on obligation

Acquisitions/Divestures/transfers

Closing balance of present Value of obligation

Reconciliation of opening and closing balance of the fair value of the Plan Assets opening balance of Fair value of plan Assets

Adjustment to opening Balance

expected Return on plan assets

Contributions

other charges (FMC, Mortality charges, etc)

Benefits paid

Actuarial Gain/(loss) Return on plan Assets

Closing balance of Fair Value of plan Assets

Actual Return on plan Assets

Current Service Cost

Interest Cost

expected Return on plan assets

net Actuarial loss/(gain) recognized in the year expenses recognized in the profit and loss Account

Funded status

Actuarial Assumptions

Discount Rate

expected Rate of Return on plan Assets expected Rate of Salary Increase employee Attrition Rate

(` in 000's)

227,763 16,571 66,627

(14,810) 14,287 - 310,438

171,565 3,127 14,459 56,221 -

(14,810) 1,743 232,305 19,329

(` in 000's)

66,627

16,571 (14,459)

9,417 78,156

100% Insurance managed funds

7.52% 7.52% 9.00%

20.26%

Changes in the present value of the obligation

As at 31/03/2020

310,438

As at 31/03/2019

19,393

109,778

(23,242)

28,184

-

444,552

232,305

16,858

35

78,134

(9,306)

-

(23,242)

294,783

7,586

Profit and Loss-Expenses

262 | AnnuAl RepoRt 2019-20

year ended 31/03/2020

109,778

Year ended 31/03/2019

19,393

(16,858)

37,456

149,769

Particulars

As at 31/03/2020

As at 31/03/2019

100% Insurance managed funds

6.40%

6.40%

9.00%

20.84%