Page 266 - Demo

P. 266

Notes to financial statements

for the year ended March 31, 2020

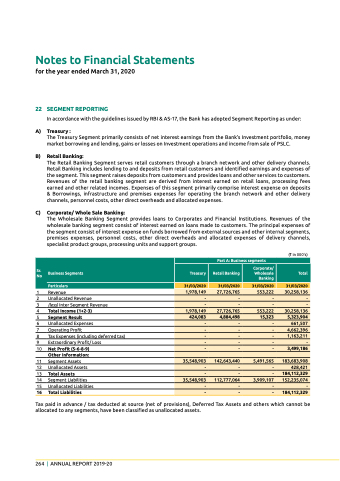

22 segMeNT RePORTINg

In accordance with the guidelines issued by RBI & AS-17, the Bank has adopted Segment Reporting as under:

A) Treasury :

the treasury Segment primarily consists of net interest earnings from the Bank’s Investment portfolio, money market borrowing and lending, gains or losses on Investment operations and income from sale of pSlC.

b) Retail banking:

the Retail Banking Segment serves retail customers through a branch network and other delivery channels. Retail Banking includes lending to and deposits from retail customers and identified earnings and expenses of the segment. this segment raises deposits from customers and provides loans and other services to customers. Revenues of the retail banking segment are derived from interest earned on retail loans, processing fees earned and other related incomes. expenses of this segment primarily comprise interest expense on deposits & Borrowings, infrastructure and premises expenses for operating the branch network and other delivery channels, personnel costs, other direct overheads and allocated expenses.

C) Corporate/ Whole sale banking:

the Wholesale Banking Segment provides loans to Corporates and Financial Institutions. Revenues of the wholesale banking segment consist of interest earned on loans made to customers. the principal expenses of the segment consist of interest expense on funds borrowed from external sources and other internal segments, premises expenses, personnel costs, other direct overheads and allocated expenses of delivery channels, specialist product groups, processing units and support groups.

(` in 000's)

Sr. No

Business Segments

Treasury

Part A: Business segments

Retail Banking

Corporate/ Wholesale Banking

Total

Particulars

31/03/2020

31/03/2020

31/03/2020

31/03/2020

1,978,149

27,726,765

553,222

30,258,136

-

-

-

-

-

-

-

-

1,978,149

27,726,765

553,222

30,258,136

424,083

4,884,498

15,323

5,323,904

-

-

-

661,507

-

-

-

4,662,396

-

-

-

1,163,211

-

-

-

-

-

-

-

3,499,186

35,548,903

142,643,440

5,491,565

183,683,908

-

-

-

428,421

-

-

-

184,112,329

35,548,903

112,777,064

3,909,107

152,235,074

-

-

-

-

-

184,112,329

-

-

1 Revenue

2 unallocated Revenue

3 (less) Inter Segment Revenue

4 Total Income (1+2-3)

5 segment Result

6 unallocated expenses

7 operating profit

8 tax expenses (including deferred tax)

9 extraordinary profit/ loss

10 Net Profit (5-6-8-9) other information:

11 Segment Assets

12 unallocated Assets

13 Total Assets

14 Segment liabilities

15 unallocated liabilities

16 Total Liabilities

tax paid in advance / tax deducted at source (net of provisions), Deferred tax Assets and others which cannot be allocated to any segments, have been classified as unallocated assets.

264 | AnnuAl RepoRt 2019-20