Page 265 - Demo

P. 265

294,783

FINANCIAL STATEMENTS

Notes to financial statements

for the year ended March 31, 2020

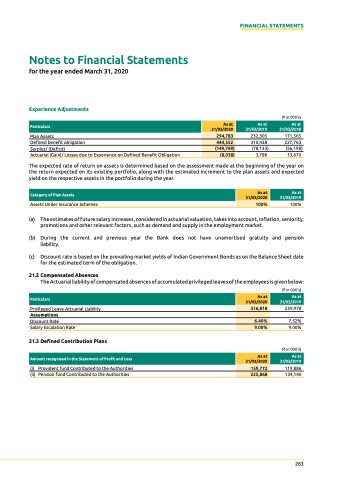

experience Adjustments

plan Assets

Defined benefit obligation

Surplus/ (Deficit)

Actuarial (Gain)/ losses due to experience on Defined Benefit obligation

232,305

310,438

(78,133)

3,788

(` in 000's)

171,565

227,763

(56,198)

13,670

Particulars

As at 31/03/2020

As at 31/03/2019

As at 31/03/2018

444,552

(149,769)

(8,038)

the expected rate of return on assets is determined based on the assessment made at the beginning of the year on the return expected on its existing portfolio, along with the estimated increment to the plan assets and expected yield on the respective assets in the portfolio during the year.

Assets under Insurance Schemes 100%

(a) the estimates of future salary increases, considered in actuarial valuation, takes into account, inflation, seniority, promotions and other relevant factors, such as demand and supply in the employment market.

(b) During the current and previous year the Bank does not have unamortised gratuity and pension liability.

(c) Discount rate is based on the prevailing market yields of Indian Government Bonds as on the Balance Sheet date for the estimated term of the obligation.

21.2 Compensated Absences

the Actuarial liability of compensated absences of accumulated privileged leaves of the employees is given below:

Category of Plan Assets

As at 31/03/2020

As at 31/03/2019

100%

Particulars

As at 31/03/2020

As at 31/03/2019

privileged leave Actuarial liability

Assumptions

Discount Rate

Salary escalation Rate

21.3 defined Contribution Plans

(i) provident fund Contributed to the Authorities

(ii) pension fund Contributed to the Authorities

(` in 000's)

259,978

7.52% 9.00%

(` in 000's)

119,886 134,140

316,818

6.40%

9.00%

Amount recognised in the Statement of Profit and Loss

As at 31/03/2020

As at 31/03/2019

159,772

225,868

263