Page 12 - CAPE Financial Services Syllabus Macmillan_Neat

P. 12

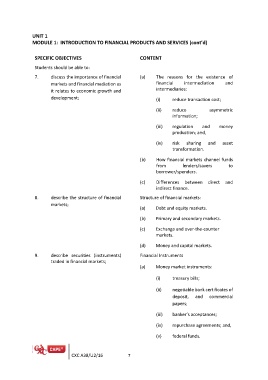

UNIT 1

MODULE 1: INTRODUCTION TO FINANCIAL PRODUCTS AND SERVICES (cont’d)

SPECIFIC OBJECTIVES CONTENT

Students should be able to:

7. discuss the importance of financial (a) The reasons for the existence of

financial intermediation and

markets and financial mediation as intermediaries:

it relates to economic growth and

development; (i) reduce transaction cost;

8. describe the structure of financial (ii) reduce asymmetric

markets;

information;

9. describe securities (instruments)

traded in financial markets; (iii) regulation and money

production; and,

(iv) risk sharing and asset

transformation.

(b) How financial markets channel funds

from lenders/savers to

borrower/spenders.

(c) Differences between direct and

indirect finance.

Structure of financial markets:

(a) Debt and equity markets.

(b) Primary and secondary markets.

(c) Exchange and over-the-counter

markets.

(d) Money and capital markets.

Financial Instruments

(a) Money market instruments:

(i) treasury bills;

(ii) negotiable bank certificates of

deposit, and commercial

papers;

(iii) banker’s acceptances;

(iv) repurchase agreements; and,

(v) federal funds.

CXC A38/U2/16 7