Page 16 - CAPE Financial Services Syllabus Macmillan_Neat

P. 16

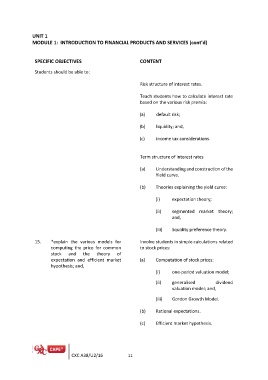

UNIT 1

MODULE 1: INTRODUCTION TO FINANCIAL PRODUCTS AND SERVICES (cont’d)

SPECIFIC OBJECTIVES CONTENT

Students should be able to:

Risk structure of interest rates.

Teach students how to calculate interest rate

based on the various risk premia:

(a) default risk;

(b) liquidity; and,

(c) income tax considerations.

Term structure of interest rates

(a) Understanding and construction of the

Yield curve.

(b) Theories explaining the yield curve:

(i) expectation theory;

(ii) segmented market theory;

and,

(iii) liquidity preference theory.

15. *explain the various models for Involve students in simple calculations related

computing the price for common to stock prices:

stock and the theory of

expectation and efficient market (a) Computation of stock prices:

hypothesis; and,

(i) one-period valuation model;

(ii) generalised dividend

valuation model; and,

(iii) Gordon Growth Model.

(b) Rational expectations.

(c) Efficient market hypothesis.

CXC A38/U2/16 11