Page 13 - CAPE Financial Services Syllabus Macmillan_Neat

P. 13

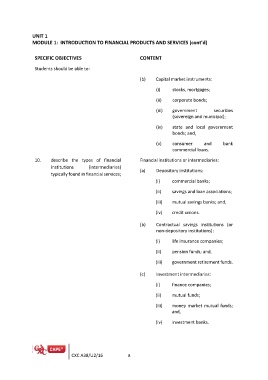

UNIT 1

MODULE 1: INTRODUCTION TO FINANCIAL PRODUCTS AND SERVICES (cont’d)

SPECIFIC OBJECTIVES CONTENT

Students should be able to:

(b) Capital market instruments:

(i) stocks, mortgages;

(ii) corporate bonds;

(iii) government securities

(sovereign and municipal);

(iv) state and local government

bonds; and,

(v) consumer and bank

commercial loans.

10. describe the types of financial Financial institutions or intermediaries:

institutions (intermediaries) (a) Depository institutions:

typically found in financial services;

(i) commercial banks;

(ii) savings and loan associations;

(iii) mutual savings banks; and,

(iv) credit unions.

(b) Contractual savings institutions (or

non-depository institutions):

(i) life insurance companies;

(ii) pension funds; and,

(iii) government retirement funds.

(c) Investment intermediaries:

(i) finance companies;

(ii) mutual funds;

(iii) money market mutual funds;

and,

(iv) investment banks.

CXC A38/U2/16 8