Page 20 - CAPE Financial Services Syllabus Macmillan_Neat

P. 20

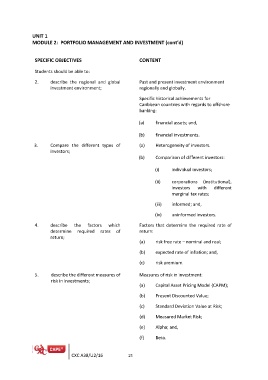

UNIT 1

MODULE 2: PORTFOLIO MANAGEMENT AND INVESTMENT (cont’d)

SPECIFIC OBJECTIVES CONTENT

Students should be able to:

2. describe the regional and global Past and present investment environment

regionally and globally.

investment environment; Specific historical achievements for

Caribbean countries with regards to offshore

3. Compare the different types of banking:

investors;

(a) financial assets; and,

4. describe the factors which

determine required rates of (b) financial investments.

return; (a) Heterogeneity of investors.

5. describe the different measures of (b) Comparison of different investors:

risk in investments;

(i) individual investors;

(ii) corporations (institutional),

investors with different

marginal tax rates;

(iii) informed; and,

(iv) uninformed investors.

Factors that determine the required rate of

return:

(a) risk free rate – nominal and real;

(b) expected rate of inflation; and,

(c) risk premium.

Measures of risk in investment:

(a) Capital Asset Pricing Model (CAPM);

(b) Present Discounted Value;

(c) Standard Deviation Value at Risk;

(d) Measured Market Risk;

(e) Alpha; and,

(f) Beta.

CXC A38/U2/16 15