Page 23 - CAPE Financial Services Syllabus Macmillan_Neat

P. 23

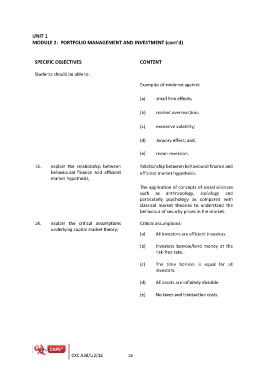

UNIT 1

MODULE 2: PORTFOLIO MANAGEMENT AND INVESTMENT (cont’d)

SPECIFIC OBJECTIVES CONTENT

Students should be able to:

Examples of evidence against:

13. explain the relationship between

behavioural finance and efficient (a) small firm effects;

market hypothesis;

(b) market overreaction;

14. explain the critical assumptions

underlying capital market theory; (c) excessive volatility;

(d) January effect; and,

(e) mean reversion.

Relationship between behavioural finance and

efficient market hypothesis.

The application of concepts of social sciences

such as anthropology, sociology and

particularly psychology as compared with

classical market theories to understand the

behaviour of security prices in the market.

Critical assumptions:

(a) All investors are efficient investors.

(b) Investors borrow/lend money at the

risk-free rate.

(c) The time horizon is equal for all

investors.

(d) All assets are infinitely divisible.

(e) No taxes and transaction costs.

CXC A38/U2/16 18