Page 25 - CAPE Financial Services Syllabus Macmillan_Neat

P. 25

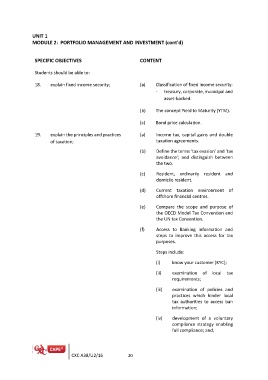

UNIT 1

MODULE 2: PORTFOLIO MANAGEMENT AND INVESTMENT (cont’d)

SPECIFIC OBJECTIVES CONTENT

Students should be able to:

18. explain fixed income security; (a) Classification of fixed income security:

- treasury, corporate, municipal and

19. explain the principles and practices asset-backed.

of taxation;

(b) The concept Yield to Maturity (YTM).

(c) Bond price calculation.

(a) Income tax, capital gains and double

taxation agreements.

(b) Define the terms ‘tax evasion’ and ‘tax

avoidance’; and distinguish between

the two.

(c) Resident, ordinarily resident and

domicile resident.

(d) Current taxation environment of

offshore financial centres.

(e) Compare the scope and purpose of

the OECD Model Tax Convention and

the UN tax Convention.

(f) Access to Banking information and

steps to improve this access for tax

purposes.

Steps include:

(i) know your customer (KYC);

(ii) examination of local tax

requirements;

(iii) examination of policies and

practices which hinder local

tax authorities to access ban

information;

(iv) development of a voluntary

compliance strategy enabling

full compliance; and,

CXC A38/U2/16 20