Page 22 - CAPE Financial Services Syllabus Macmillan_Neat

P. 22

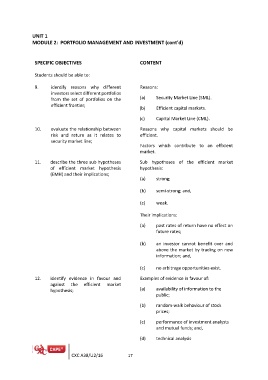

UNIT 1

MODULE 2: PORTFOLIO MANAGEMENT AND INVESTMENT (cont’d)

SPECIFIC OBJECTIVES CONTENT

Students should be able to:

9. identify reasons why different Reasons:

(a) Security Market Line (SML).

investors select different portfolios (b) Efficient capital markets.

from the set of portfolios on the (c) Capital Market Line (CML).

efficient frontier; Reasons why capital markets should be

efficient.

10. evaluate the relationship between Factors which contribute to an efficient

risk and return as it relates to market.

security market line; Sub hypotheses of the efficient market

hypothesis:

11. describe the three sub hypotheses (a) strong;

of efficient market hypothesis

(EMH) and their implications; (b) semi-strong; and,

12. identify evidence in favour and (c) weak.

against the efficient market

hypothesis; Their implications:

(a) past rates of return have no effect on

future rates;

(b) an investor cannot benefit over and

above the market by trading on new

information; and,

(c) no arbitrage opportunities exist.

Examples of evidence in favour of:

(a) availability of information to the

public;

(b) random-walk behaviour of stock

prices;

(c) performance of investment analysts

and mutual funds; and,

(d) technical analysis

CXC A38/U2/16 17