Page 34 - CAPE Financial Services Syllabus Macmillan_Neat

P. 34

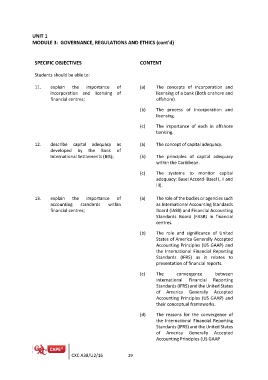

UNIT 1

MODULE 3: GOVERNANCE, REGULATIONS AND ETHICS (cont’d)

SPECIFIC OBJECTIVES CONTENT

Students should be able to:

11. explain the importance of (a) The concepts of incorporation and

licensing of a bank (Both onshore and

incorporation and licensing of offshore).

financial centres;

(b) The process of incorporation and

12. describe capital adequacy as licensing.

developed by the Bank of

International Settlements (BIS); (c) The importance of each in offshore

banking.

13. explain the importance of

accounting standards within (a) The concept of capital adequacy.

financial centres;

(b) The principles of capital adequacy

within the Caribbean.

(c) The systems to monitor capital

adequacy: Basel Accord- Basel I, II and

III).

(a) The role of the bodies or agencies such

as International Accounting Standards

Board (IASB) and Financial Accounting

Standards Board (FASB) in financial

centres.

(b) The role and significance of United

States of America Generally Accepted

Accounting Principles (US GAAP) and

the International Financial Reporting

Standards (IFRS) as it relates to

presentation of financial reports.

(c) The convergence between

International Financial Reporting

Standards (IFRS) and the United States

of America Generally Accepted

Accounting Principles (US GAAP) and

their conceptual frameworks.

(d) The reasons for the convergence of

the International Financial Reporting

Standards (IFRS) and the United States

of America Generally Accepted

Accounting Principles (US GAAP

CXC A38/U2/16 29