Page 41 - CAPE Financial Services Syllabus Macmillan_Neat

P. 41

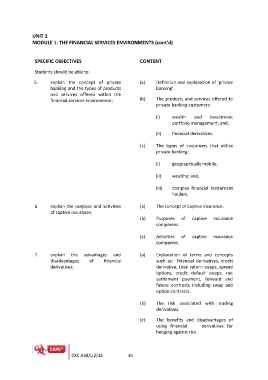

UNIT 2

MODULE 1: THE FINANCIAL SERVICES ENVIRONMENTS (cont’d)

SPECIFIC OBJECTIVES CONTENT

Students should be able to:

5. explain the concept of private (a) Definition and explanation of ‘private

banking’.

banking and the types of products

and services offered within the (b) The products and services offered to

financial services environment; private banking customers:

6. explain the purpose and activities (i) wealth and investment

of captive insurance; portfolio management; and,

7. explain the advantages and (ii) financial derivatives.

disadvantages of financial

derivatives; (c) The types of customers that utilise

private banking:

(i) geographically mobile;

(ii) wealthy; and,

(iii) complex financial instrument

holders.

(a) The concept of captive insurance.

(b) Purposes of captive insurance

companies.

(c) Activities of captive insurance

companies.

(a) Explanation of terms and concepts

such as: financial derivatives, credit

derivative, total return swaps, spread

options, credit default swaps, net

settlement payment, forward and

future contracts including swap and

option contracts.

(b) The risk associated with trading

derivatives.

(c) The benefits and disadvantages of

using financial derivatives for

hedging against risk.

CXC A38/U2/16 36