Page 80 - CAPE Financial Services Syllabus Macmillan_Neat

P. 80

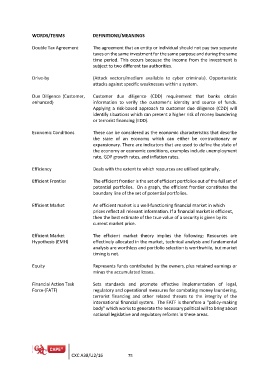

WORDS/TERMS DEFINITIONS/MEANINGS

Double Tax Agreement The agreement that an entity or individual should not pay two separate

taxes on the same investment for the same purpose and during the same

time period. This occurs because the income from the investment is

subject to two different tax authorities.

Drive-by (Attack vectors/medium available to cyber criminals). Opportunistic

attacks against specific weaknesses within a system.

Due Diligence (Customer, Customer due diligence (CDD) requirement that banks obtain

enhanced) information to verify the customer’s identity and source of funds.

Applying a risk-based approach to customer due diligence (CDD) will

identify situations which can present a higher risk of money laundering

or terrorist financing (EDD).

Economic Conditions These can be considered as the economic characteristics that describe

the state of an economy which can either be contractionary or

expansionary. There are indicators that are used to define the state of

the economy or economic conditions, examples include unemployment

rate, GDP growth rates, and inflation rates.

Efficiency Deals with the extent to which resources are utilised optimally.

Efficient Frontier The efficient frontier is the set of efficient portfolios out of the full set of

potential portfolios. On a graph, the efficient frontier constitutes the

boundary line of the set of potential portfolios.

Efficient Market An efficient market is a well-functioning financial market in which

prices reflect all relevant information. If a financial market is efficient,

then the best estimate of the true value of a security is given by its

current market price.

Efficient Market The efficient market theory implies the following: Resources are

Hypothesis (EMH) effectively allocated in the market, technical analysis and fundamental

analysis are worthless and portfolio selection is worthwhile, but market

timing is not.

Equity Represents funds contributed by the owners, plus retained earnings or

minus the accumulated losses.

Financial Action Task Sets standards and promote effective implementation of legal,

Force (FATF) regulatory and operational measures for combating money laundering,

terrorist financing and other related threats to the integrity of the

international financial system. The FATF is therefore a “policy-making

body” which works to generate the necessary political will to bring about

national legislative and regulatory reforms in these areas.

CXC A38/U2/16 75