Page 84 - CAPE Financial Services Syllabus Macmillan_Neat

P. 84

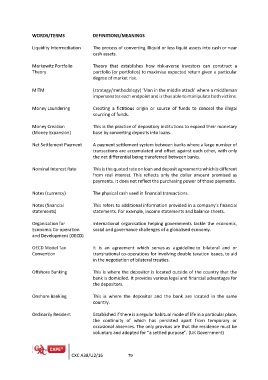

WORDS/TERMS DEFINITIONS/MEANINGS

Liquidity Intermediation

The process of converting illiquid or less liquid assets into cash or near

Markowitz Portfolio cash assets.

Theory

Theory that establishes how risk-averse investors can construct a

MITM portfolio (or portfolios) to maximise expected return given a particular

degree of market risk.

Money Laundering

(strategy/methodology) ‘Man in the middle attack’ where a middleman

Money Creation impersonates each endpoint and is thus able to manipulate both victims.

(Money Expansion)

Net Settlement Payment Creating a fictitious origin or source of funds to conceal the illegal

sourcing of funds.

Nominal Interest Rate

This is the practice of depository institutions to expand their monetary

Notes (currency) base by converting deposits into loans.

Notes (financial

statements) A payment settlement system between banks where a large number of

Organization for transactions are accumulated and offset against each other, with only

Economic Co-operation the net differential being transferred between banks.

and Development (OECD)

OECD Model Tax This is the quoted rate on loan and deposit agreements which is different

Convention from real interest. This reflects only the dollar amount promised as

payments. It does not reflect the purchasing power of those payments.

Offshore Banking

The physical cash used in financial transactions.

Onshore Banking

This refers to additional information provided in a company’s financial

Ordinarily Resident statements. For example, income statements and balance sheets.

International organisation helping governments tackle the economic,

social and governance challenges of a globalised economy.

It is an agreement which serves as a guideline to bilateral and or

transnational co-operations for involving double taxation issues, to aid

in the negotiation of bilateral treaties.

This is where the depositor is located outside of the country that the

bank is domiciled. It provides various legal and financial advantages for

the depositors.

This is where the depositor and the bank are located in the same

country.

Established if there is a regular habitual mode of life in a particular place,

the continuity of which has persisted apart from temporary or

occasional absences. The only provisos are that the residence must be

voluntary and adopted for “a settled purpose". (UK Government)

CXC A38/U2/16 79