Page 81 - CAPE Financial Services Syllabus Macmillan_Neat

P. 81

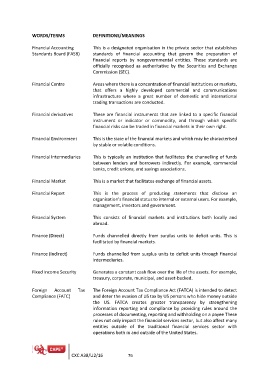

WORDS/TERMS DEFINITIONS/MEANINGS

Financial Accounting This is a designated organisation in the private sector that establishes

Standards Board (FASB) standards of financial accounting that govern the preparation of

financial reports by nongovernmental entities. Those standards are

officially recognised as authoritative by the Securities and Exchange

Commission (SEC).

Financial Centre Areas where there is a concentration of financial institutions or markets,

that offers a highly developed commercial and communications

infrastructure where a great number of domestic and international

trading transactions are conducted.

Financial derivatives These are financial instruments that are linked to a specific financial

instrument or indicator or commodity, and through which specific

financial risks can be traded in financial markets in their own right.

Financial Environment This is the state of the financial markets and which may be characterised

by stable or volatile conditions.

Financial Intermediaries This is typically an institution that facilitates the channelling of funds

between lenders and borrowers indirectly. For example, commercial

banks, credit unions, and savings associations.

Financial Market This is a market that facilitates exchange of financial assets.

Financial Report This is the process of producing statements that disclose an

organisation’s financial status to internal or external users. For example,

management, investors and government.

Financial System This consists of financial markets and institutions both locally and

abroad.

Finance (Direct) Funds channelled directly from surplus units to deficit units. This is

facilitated by financial markets.

Finance (Indirect) Funds channelled from surplus units to deficit units through financial

intermediaries.

Fixed Income Security Generates a constant cash flow over the life of the assets. For example,

treasury, corporate, municipal, and asset-backed.

Foreign Account Tax The Foreign Account Tax Compliance Act (FATCA) is intended to detect

Compliance (FATC) and deter the evasion of US tax by US persons who hide money outside

the US. FATCA creates greater transparency by strengthening

information reporting and compliance by providing rules around the

processes of documenting, reporting and withholding on a payee These

rules not only impact the financial services sector, but also affect many

entities outside of the traditional financial services sector with

operations both in and outside of the United States.

CXC A38/U2/16 76