Page 87 - CAPE Financial Services Syllabus Macmillan_Neat

P. 87

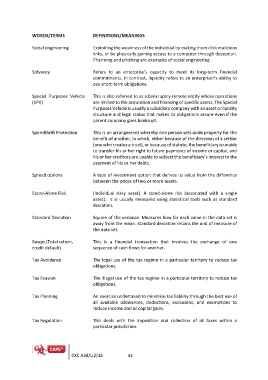

WORDS/TERMS DEFINITIONS/MEANINGS

Social engineering Exploiting the weakness of the individual by making them click malicious

links, or by physically gaining access to a computer through deception.

Pharming and phishing are examples of social engineering.

Solvency Refers to an enterprise’s capacity to meet its long-term financial

commitments. In contrast, liquidity refers to an enterpriser’s ability to

pay short-term obligations.

Special Purposes Vehicle This is also referred to as a bankruptcy remote entity whose operations

(SPV) are limited to the acquisition and financing of specific assets. The Special

Purposes Vehicle is usually a subsidiary company with an asset or liability

structure and legal status that makes its obligations secure even if the

parent company goes bankrupt.

Spendthrift Protection This is an arrangement whereby one person sets aside property for the

benefit of another, in which, either because of the direction of a settlor

(one who creates a trust), or because of statute, the beneficiary is unable

to transfer his or her right to future payments of income or capital, and

his or her creditors are unable to subject the beneficiary’s interest to the

payment of his or her debts.

Spread options A type of investment option that derives its value from the difference

between the prices of two or more assets.

Stand-Alone Risk (Individual risky asset). A stand-alone risk (associated with a single

asset). It is usually measured using statistical tools such as standard

deviation.

Standard Deviation Square of the variance. Measures how far each value in the data set is

away from the mean. Standard deviation retains the unit of measure of

the data set.

Swaps (Total return, This is a financial transaction that involves the exchange of one

credit default) sequence of cash flows for another.

Tax Avoidance The legal use of the tax regime in a particular territory to reduce tax

obligations.

Tax Evasion The illegal use of the tax regime in a particular territory to reduce tax

obligations.

Tax Planning An exercise undertaken to minimise tax liability through the best use of

all available allowances, deductions, exclusions, and exemptions to

reduce income and or capital gains.

Tax Regulation This deals with the imposition and collection of all taxes within a

particular jurisdiction.

CXC A38/U2/16 82