Page 56 - CSJ - ADF - AMB 10 07 19

P. 56

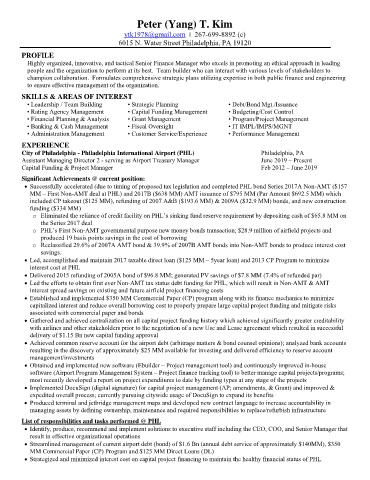

Peter (Yang) T. Kim

ytk1978@gmail.com ǁ 267-699-8892 (c)

6015 N. Water Street Philadelphia, PA 19120

PROFILE

Highly organized, innovative, and tactical Senior Finance Manager who excels in promoting an ethical approach in leading

people and the organization to perform at its best. Team builder who can interact with various levels of stakeholders to

champion collaboration. Formulates comprehensive strategic plans utilizing expertise in both public finance and engineering

to ensure effective management of the organization.

SKILLS & AREAS OF INTEREST

• Leadership / Team Building • Strategic Planning • Debt/Bond Mgt./Issuance

• Rating Agency Management • Capital Funding Management • Budgeting/Cost Control

• Financial Planning & Analysis • Grant Management • Program/Project Management

• Banking & Cash Management • Fiscal Oversight • IT IMPL/IMPS/MGNT

• Administration Management • Customer Service/Experience • Performance Management

EXPERIENCE

City of Philadelphia - Philadelphia International Airport (PHL) Philadelphia, PA

Assistant Managing Director 2 - serving as Airport Treasury Manager June 2019 – Present

Capital Funding & Project Manager Feb 2012 – June 2019

Significant Achievements @ current position:

Successfully accelerated (due to timing of proposed tax legislation and completed PHL bond Series 2017A Non-AMT ($157

MM – First Non-AMT deal at PHL) and 2017B ($638 MM) AMT issuance of $795 MM (Par Amount $692.5 MM) which

included CP takeout ($125 MM), refunding of 2007 A&B ($193.6 MM) & 2009A ($32.9 MM) bonds, and new construction

funding ($334 MM)

o Eliminated the reliance of credit facility on PHL’s sinking fund reserve requirement by depositing cash of $65.8 MM on

the Series 2017 deal

o PHL’s First Non‐AMT governmental purpose new money bonds transaction; $28.9 million of airfield projects and

produced 19 basis points savings in the cost of borrowing

o Reclassified 29.6% of 2007A AMT bond & 39.9% of 2007B AMT bonds into Non-AMT bonds to produce interest cost

savings.

Led, accomplished and maintain 2017 taxable direct loan ($125 MM – 5year loan) and 2013 CP Program to minimize

interest cost at PHL

Delivered 2015 refunding of 2005A bond of $96.8 MM; generated PV savings of $7.8 MM (7.4% of refunded par)

Led the efforts to obtain first ever Non-AMT tax status debt funding for PHL, which will result in Non-AMT & AMT

interest spread savings on existing and future airfield project financing costs

Established and implemented $350 MM Commercial Paper (CP) program along with its finance mechanics to minimize

capitalized interest and reduce overall borrowing cost to properly prepare large capital project funding and mitigate risks

associated with commercial paper and bonds

Gathered and achieved centralization on all capital project funding history which achieved significantly greater creditability

with airlines and other stakeholders prior to the negotiation of a new Use and Lease agreement which resulted in successful

delivery of $1.15 Bn new capital funding approval

Achieved common reserve account for the airport debt (arbitrage matters & bond counsel opinions); analyzed bank accounts

resulting in the discovery of approximately $25 MM available for investing and delivered efficiency to reserve account

management/investments

Obtained and implemented new software (Ebuilder – Project management tool) and continuously improved in-house

software (Airport Program Management System – Project finance tracking tool) to better manage capital projects/programs;

most recently developed a report on project expenditures to date by funding types at any stage of the projects

Implemented DocuSign (digital signature) for capital project management (AP; amendments, & Grant) and improved &

expedited overall process; currently pursuing citywide usage of DocuSign to expand its benefits

Produced terminal and jetbridge management maps and developed new contract language to increase accountability in

managing assets by defining ownership, maintenance and required responsibilities to replace/refurbish infrastructure

List of responsibilities and tasks performed @ PHL

Identify, produce, recommend and implement solutions to executive staff including the CEO, COO, and Senior Manager that

result in effective organizational operations

Streamlined management of current airport debt (bond) of $1.6 Bn (annual debt service of approximately $140MM), $350

MM Commercial Paper (CP) Program and $125 MM Direct Loans (DL)

Strategized and minimized interest cost on capital project financing to maintain the healthy financial status of PHL