Page 8 - 2021 Open Sky Employee Benefits - SALARIED

P. 8

12/1/2020-11/30/2021 Employee Benefits Brochure

Salaried

Employee Assistance Program - Triad

Open Sky Wilderness provides you Employee Assistance Program benefits that is 100% employer paid.

When you face a problem or crisis, the Employee Assistance Program offers help and support with a wide

range of issues that many of us face. Up to three face-to-face sessions per year with a licensed mental

health provider at no charge.

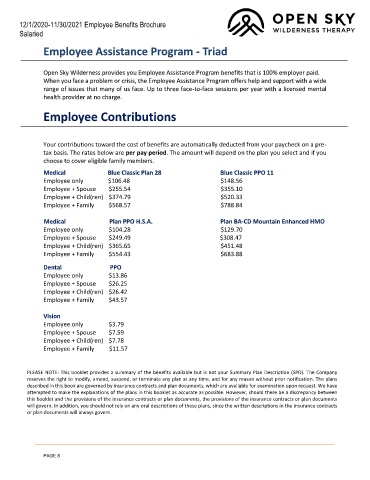

Employee Contributions

Your contributions toward the cost of benefits are automatically deducted from your paycheck on a pre-

tax basis. The rates below are per pay period. The amount will depend on the plan you select and if you

choose to cover eligible family members.

Medical Blue Classic Plan 28 Blue Classic PPO 11

Employee only $106.48 $148.56

Employee + Spouse $255.54 $355.10

Employee + Child(ren) $374.79 $520.33

Employee + Family $568.57 $788.84

Medical Plan PPO H.S.A. Plan BA-CD Mountain Enhanced HMO

Employee only $104.28 $129.70

Employee + Spouse $249.49 $308.47

Employee + Child(ren) $365.65 $451.48

Employee + Family $554.43 $683.88

Dental PPO

Employee only $13.86

Employee + Spouse $26.25

Employee + Child(ren) $26.42

Employee + Family $43.57

Vision

Employee only $3.79

Employee + Spouse $7.59

Employee + Child(ren) $7.78

Employee + Family $11.57

PLEASE NOTE: This booklet provides a summary of the benefits available but is not your Summary Plan Description (SPD). The Company

reserves the right to modify, amend, suspend, or terminate any plan at any time, and for any reason without prior notification. The plans

described in this book are governed by insurance contracts and plan documents, which are available for examination upon request. We have

attempted to make the explanations of the plans in this booklet as accurate as possible. However, should there be a discrepancy between

this booklet and the provisions of the insurance contracts or plan documents, the provisions of the insurance contracts or plan documents

will govern. In addition, you should not rely on any oral descriptions of these plans, since the written descriptions in the insurance contracts

or plan documents will always govern.

PAGE 8