Page 6 - 2021-22 Velocity Employee Benefits Brochure

P. 6

Velocity Mortgage Capital

2021–2022 Employee Benefits Brochure

Medical Plans

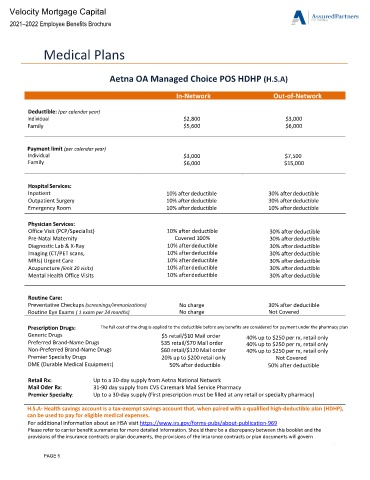

Aetna OA Managed Choice POS HDHP (H.S.A)

In-Network Out-of-Network

Deductible: (per calendar year)

Individual $2,800 $3,000

Family $5,600 $6,000

Payment limit (per calendar year)

Individual $3,000 $7,500

Family $6,000 $15,000

Hospital Services:

Inpatient 10% after deductible 30% after deductible

Outpatient Surgery 10% after deductible 30% after deductible

Emergency Room 10% after deductible 10% after deductible

Physician Services:

Office Visit (PCP/Specialist) 10% after deductible 30% after deductible

Pre-Natal Maternity Covered 100% 30% after deductible

Diagnostic Lab & X-Ray 10% after deductible 30% after deductible

Imaging (CT/PET scans, 10% after deductible 30% after deductible

MRIs) Urgent Care 10% after deductible 30% after deductible

Acupuncture (limit 20 visits) 10% after deductible 30% after deductible

Mental Health Office Visits 10% after deductible 30% after deductible

Routine Care:

Preventative Checkups (screenings/immunizations) No charge 30% after deductible

Routine Eye Exams ( 1 exam per 24 months) No charge Not Covered

Prescription Drugs: The full cost of the drug is applied to the deductible before any benefits are considered for payment under the pharmacy plan

Generic Drugs $5 retail/$10 Mail order 40% up to $250 per rx, retail only

Preferred Brand-Name Drugs $35 retail/$70 Mail order 40% up to $250 per rx, retail only

Non-Preferred Brand-Name Drugs $60 retail/$120 Mail order 40% up to $250 per rx, retail only

Premier Specialty Drugs 20% up to $200 retail only Not Covered

DME (Durable Medical Equipment) 50% after deductible 50% after deductible

Retail Rx: Up to a 30-day supply from Aetna National Network

Mail Oder Rx: 31-90 day supply from CVS Caremark Mail Service Pharmacy

Premier Specialty: Up to a 30-day supply (First prescription must be filled at any retail or specialty pharmacy)

H.S.A- Health savings account is a tax-exempt savings account that, when paired with a qualified high-deductible plan (HDHP),

can be used to pay for eligible medical expenses.

For additional information about an HSA visit https://www.irs.gov/forms-pubs/about-publication-969

Please refer to carrier benefit summaries for more detailed information. Should there be a discrepancy between this booklet and the

provisions of the insurance contracts or plan documents, the provisions of the insurance contracts or plan documents will govern

PAGE 5