Page 11 - TERM SHEET - PROJECT FINANCE CONCEPTION - english

P. 11

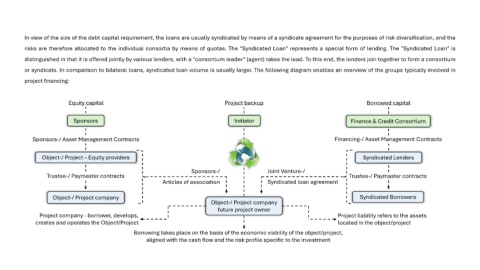

In view of the size of the debt capital requirement, the loans are usually syndicated by means of a syndicate agreement for the purposes of risk diversification, and the

risks are therefore allocated to the individual consortia by means of quotas. The "Syndicated Loan" represents a special form of lending. The "Syndicated Loan" is

distinguished in that it is offered jointly by various lenders, with a "consortium leader” (agent) takes the lead. To this end, the lenders join together to form a consortium

or syndicate. In comparison to bilateral loans, syndicated loan volume is usually larger. The following diagram enables an overview of the groups typically involved in

project financing:

Equity capital Project backup Borrowed capital

Sponsors Initiator Finance & Credit Consortium

Sponsors-/ Asset Management Contracts Financing-/ Asset Management Contracts

Object-/ Project – Equity providers Syndicated Lenders

Sponsors-/ Joint Venture-/

Trustee-/ Paymaster contracts Trustee-/ Paymaster contracts

Articles of association Syndicated loan agreement

Object-/ Project company Syndicated Borrowers

Object-/ Project company

future project owner

Project company - borrower, develops, Project liability refers to the assets

creates and operates the Object/Project located in the object/project

Borrowing takes place on the basis of the economic viability of the object/project,

aligned with the cash flow and the risk profile specific to the investment