Page 16 - Gray_2020 Benefit Guide

P. 16

Quick Contact Details:

PHONE: 513-459-9997 or 800-982-7715

Your Health WEBSITE: chard-snyder.com

FLEXIBLE Login to your Chard Snyder

account at chard-snyder.com

SPENDING Download Chard Snyder Mobile

in the App Store or Google Play

ACCOUNTS

How do I save money by enrolling

in an FSA?

Flexible Spending Accounts (FSAs) Contributions are deposited into your

offer an easy way to pay less in FSA before taxes are calculated on your

taxes while paying for healthcare paycheck. This lowers your taxable income

and dependent care expenses. and you pay less in taxes. In short, you get

a tax break for putting money aside for

What is a Flexible Spending Account expenses you would have paid for anyway.

and what does it do?

Gray offers carryover of the Healthcare and

The Flexible Spending Account, as designed

Limited Purpose Healthcare FSAs, which

by the IRS, allows for three separate accounts:

allows team members to carry over up to

Healthcare, Limited Purpose Healthcare and

$500 from last year’s funds into the new

Dependent Care. Each account is designed

plan year. This money becomes part of the

to help you save 25-40% in taxes on

balance in your plan and is used the same

merchandise and services you already buy.

way as the money for the new plan year.

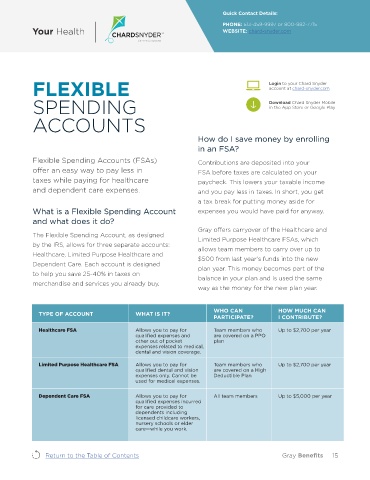

WHO CAN HOW MUCH CAN

TYPE OF ACCOUNT WHAT IS IT?

PARTICIPATE? I CONTRIBUTE?

Healthcare FSA Allows you to pay for Team members who Up to $2,700 per year

qualified expenses and are covered on a PPO

other out of pocket plan

expenses related to medical,

dental and vision coverage.

Limited Purpose Healthcare FSA Allows you to pay for Team members who Up to $2,700 per year

qualified dental and vision are covered on a High

expenses only. Cannot be Deductible Plan

used for medical expenses.

Dependent Care FSA Allows you to pay for All team members Up to $5,000 per year

qualified expenses incurred

for care provided to

dependents including

licensed childcare workers,

nursery schools or elder

care—while you work.

Return to the Table of Contents Gray Benefits 15