Page 127 - ZaZa Q12021 Owners Meeting_Neat

P. 127

HOTEL HORIZONS ® Q4 2020 EDITION Nashville, TN

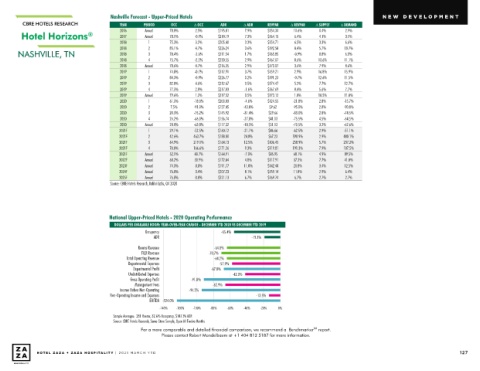

Nashville Forecast - Upper-Priced Hotels NEW DEVEL OPMENT

CBRE HOTELS RESEARCH YEAR PERIOD OCC Δ OCC ADR Δ ADR REVPAR Δ REVPAR Δ SUPPLY Δ DEMAND

2016 Annual 78.8% 2.5% $195.81 7.9% $154.34 10.6% 0.4% 2.9%

e

l

H Hotel Horizons ® 2017 Annual 78.1% -0.9% $210.192020 EDITION $164.15 6.4% 4.1% 3.1%

o

t

H

o

n

s

z

o

r

i

Q4

7.3%

2018 1 75.3% 3.2% $205.40 3.3% $154.71 6.5% 3.3% 6.6%

2018 2 85.1% 4.7% $226.24 3.6% $192.58 8.4% 5.7% 10.7%

I

L

V

A

S

H

L

T

N

N NASHVILLE, TN 2018 3 78.4% -2.6% $211.54 1.7% $165.85 -0.9% 8.8% 6.0%

E

,

75.7%

4

Regional Economic Summary 2018 Hotel Market Summary -2.2% $220.55 2.9% $167.07 0.6% 13.6% 11.1%

2.9%

7.9%

$170.07

3.6%

2018

8.6%

0.7%

$216.35

78.6%

Annual

“Business contacts in the Sixth District indicated that In 2020, Nashville hotels finished the year with a RevPAR $159.21 2.9% 16.8% 15.9%

$212.91

74.8%

3.7%

1

-0.7%

2019

economic activity continued to expand at a modest pace decline of 62.1%. This was the result of a decline in 0.2% $191.23 -0.7% 12.6% 11.5%

$226.77

84.3%

-0.9%

2019

2

from mid-November through December. Labor markets occupancy of 45.8% and a 30.1% decrease in average daily $174.47 5.2% 7.7% 12.7%

4.6%

82.0%

2019

$212.67

0.5%

3

continued to gradually improve, and wage pressures were room rates (ADR). The 62.1% decline in Nashville RevPAR

See use and distribution restrictions on the last page of this report. Downloaded by Matthew Nuss, asdf

4

77.3%

$217.03

2019

2.0%

muted, on balance. Nonlabor costs related to construction was greater than the national decline of 51.8%. -1.6% $167.69 0.4% 5.6% 7.7%

2019

and supply chains rose further over the reporting period. Annual 79.6% 1.2% $217.52 0.5% $173.12 1.8% 10.5% 11.8%

2020

$203.03

61.3%

-18.0%

1

-4.6%t

Although retail contacts reported overall holiday sales were Nashville's upper-priced properties suffered the greates $124.55 -21.8% 2.8% -15.7%

2

-43.8%

-91.0%

2020

$127.45

7.5%

subdued, ecommerce activity remained strong. Auto dealers decline in RevPAR during 2020. The properties in this $9.62 -95.0% 2.8% -90.8%

-75.2%

2020

$145.92

20.3%

-31.4%

3

See use and distribution restrictions on the last page of this report. Downloaded by Matthew Nuss, asdf

noted sales declined since the previous report. Tourism and category experienced a 63.8% drop in occupancy and a 18.5% $29.66 -83.0% 2.8% -74.5%

$156.74

-66.0%

-27.8%

2020

26.2%

4

hospitality activity softened. Residential real estate demand decrease in ADR. Middle-priced hotels saw their RevPAR $41.13 -75.5% 4.5% -64.5%

-63.8%

-18.5%

28.8%

$177.32

Annual

2020

remained strong, but challenges in commercial real estate decline by 61.3% during the year, while lower-priced $51.13 -70.5% 3.2% -62.6%

1

$160.12

29.1%

2021F

-52.5%

markets persisted. Overall manufacturing activity rose properties experienced a RevPAR fall of 36.7%. -21.1% $46.66 -62.5% 2.9% -51.1%

moderately. Banking conditions remained stable, but some Moving into 2021, Nashville RevPAR is expected to grow $67.23 598.9% 2.9% 480.1%

463.7%

42.6%

2021F

$158.00

2

24.0%

contacts noted an uptick in delinquencies, mostly with 45.1%. By year-end 2021, Nashville RevPAR will still be 45.0% $106.45 258.9% 5.7% 237.2%

2021F

$164.13

219.1%

64.9%

12.5%

3

residential mortgages. 2021F less than the 2019 RevPAR level. RevPAR for Nashville hotels $119.81 191.3% 7.9% 187.5%

70.0%

4

$171.26

9.3%

166.6%

Travel and tourism activity softened since the previous is no 52.1% 80.7% $164.91 -7.0% $85.95 68.1% 4.9% 89.5%

Annualt expected to surpass 2019 levels until 2024. For the

2021F

report. Contacts noted that properties affected by recent year, occupancy is forecast to grow by 44.6%, while average $117.91 37.2% 7.7% 41.0%

30.9%

$172.84

68.2%

4.8%

2022F

Annual

hurricanes, primarily in Alabama, had not completed repairs room rates are projected to increase 0.3%. 11.0% $142.40 20.8% 3.4% 12.5%

74.3%

8.8%

2023F

Annual

$191.77

as quickly as anticipated, which led to canceled reservations. Annual 76.8% 3.4% $207.23 8.1% $159.14 11.8% 2.9% 6.4%

2024F

Drive-to destinations across the District continued to Annual 76.8% 0.0% $221.13 6.7% $169.74 6.7% 2.7% 2.7%

2025F

experience solid activity; however, some contacts anticipate

Source: CBRE Hotels Research, Kalibri Labs, Q4 2020

that surges in COVID-19 cases would dampen demand in the

near term..”

Federal Reserve Bank Beige Book, January 2021 2020 Annual Change in RevPAR

All Hotels Upper-Priced Mid-Priced Lower-Priced

National Upper-Priced Hotels - 2020 Operating Performance

Nashville: Next 4 Quarters DOLLARS PER AVAILABLE ROOM: YEAR-OVER-YEAR CHANGE - DECEMBER YTD 2020 VS DECEMBER YTD 2019

The arrows show the forecast direction of change over the next 4 quarters vs. the

previous 4 quarters. Green indicates the change will be above the long run average, Occupancy -55.4%

yellow indicates it will be the same, and orange indicates it will be below. ADR -36.7% -19.1%

Occupancy Rooms Revenue -64.0%

Occupancy will increase to 58.1%, better than the previous 4 quarters' F&B Revenue -62.1% -70.7%

-61.3%

rate of 40.2%, but below the long run average of 66.1% Total Operating Revenue -64.2%

Departmental Expenses -70.5% -57.9%

Departmental Profit -67.8%

Average Daily Rate Undistributed Expenses Source: Kalibri Labs, Q4 2020

ADR growth expectations are increasing, positive 0.3% vs. the past 4 Gross Operating Profit -91.8% -42.0%

Annual Performance - Five Year History and Forecast

quarters' rate of negative 30.1%, but are below the long run average of Management Fees OCC Δ OCC ADR -65.9% REVPAR Δ REVPAR

Δ ADR

YEAR

positive 1.7% Income Before Non-Operating 76.4% 2.4% -94.2% $139.92 6.0% $106.90 8.5%

2016

Revenue Per Available Room Non-Operating Income and Expenses 75.9% -0.7% $147.58 5.5% $111.97 4.7% -13.5%

2017

2018

74.1%

RevPAR growth projections are climbing to 45.1% as compared to the EBITDA -124.0% -2.4% $152.19 3.1% $112.73 0.7%

past 4 quarters' rate of negative 62.1%, and are greater than the long 2019 -140% 74.2% -120% 0.1% -100% $153.09 -80% 0.6% -60% $113.54 -40% 0.7% -20% 0%

run average of positive 1.1% 2020 40.2% -45.8% $107.07 -30.1% $43.05 -62.1%

2021F

Supply (orange indicates above long-term average) Sample Averages: 281 Rooms, 32.6% Occupancy, $147.96 ADR $107.43 0.3% $62.45 45.1%

58.1%

44.6%

Source: CBRE Hotels Research, Same-Store Sample, Open All Twelve Months

Supply growth is less active, 5.4% vs. the past 4 quarters' rate of 6.1%, 2022F 68.4% 17.7% $124.89 16.3% $85.49 36.9%

though it is greater than the long run average of 2.3% For a more comparable and detailed financial comparison, we recommend a Benchmarker report.

6.8%

73.1%

SM

2023F

$104.30

14.2%

$142.64

22.0%

10.7%

2024F Please contact Robert Mandelbaum at +1 404 812 5187 for more information.

74.6%

2.0%

8.6%

$115.51

$154.94

Demand 2025F 74.2% -0.5% $163.43 5.5% $121.18 4.9%

Forecast demand growth is climbing, positive 52.4% vs. the past 4 Long Run Averages 2000 to 2020 P. 5 / CBRE HOTELS RESEARCH

quarters' rate of negative 42.5%, and is greater than the long run 127

HO TEL ZAZA + ZAZA HO SPIT ALITY | 20 21 MARCH YTD

average of positive 0.8% Occupancy: 66.1%, ADR Change: 1.7%, RevPAR Change: 1.1%

Source: CBRE Hotels Research, Kalibri Labs, Q4 2020