Page 129 - ZaZa Q12021 Owners Meeting_Neat

P. 129

HOTEL HORIZONS ® Q4 2020 EDITION Nashville, TN

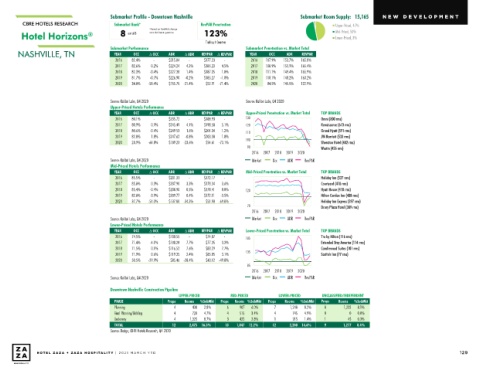

Submarket Profile - Downtown Nashville Submarket Room Supply: 15,165 NEW DEVEL OPMENT

CBRE HOTELS RESEARCH Submarket Rank* *Based on RevPAR change RevPAR Penetration Upper-Priced, 47%

2

3

%

e

l

H Hotel Horizons ® 8 8 out of 8 over the last 4 quarters. 1 123% Mid-Priced, 50%

o

t

H

o

n

s

z

o

r

i

Q4 2020 EDITION

Lower-Priced, 3%

Trailing 4 Quarters

Submarket Performance Submarket Penetration vs. Market Total

V

I

A

N NASHVILLE, TN YEAR OCC Δ OCC ADR Δ ADR REVPAR Δ REVPAR YEAR OCC ADR REVPAR

H

S

T

N

,

L

L

E

$215.04

-

-

-

Regional Economic Summary 2016 82.4% Hotel Market Summary 4.3% $177.23 4.5% 2016 107.9% 153.7% 165.8%

2017

82.6%

151.9%

$224.24

108.9%

2017

165.4%

0.2%

$185.23

“Business contacts in the Sixth District indicated that 82.3% In 2020, Nashville hotels finished the year with a RevPAR 111.1% 149.4% 165.9%

-0.4%

2018

1.4%

1.0%

$227.38

$187.05

2018

economic activity continued to expand at a modest pace 81.7% decline of 62.1%. This was the result of a decline in 2019 110.1% 148.2% 163.2%

$185.27

2019

-0.2%

-1.0%

-0.7%

$226.90

from mid-November through December. Labor markets 34.0% occupancy of 45.8% and a 30.1% decrease in average daily 84.5% 145.5% 122.9%

2020

$155.75 -31.4%

-58.4%

2020

$52.91 -71.4%

continued to gradually improve, and wage pressures were room rates (ADR). The 62.1% decline in Nashville RevPAR

See use and distribution restrictions on the last page of this report. Downloaded by Matthew Nuss, asdf

muted, on balance. Nonlabor costs related to construction was greater than the national decline of 51.8%.

and supply chains rose further over the reporting period.

Source: Kalibri Labs, Q4 2020

Source: Kalibri Labs, Q4 2020

Although retail contacts reported overall holiday sales were Nashville's upper-priced properties suffered the greatest

Upper-Priced Hotels Performance

subdued, ecommerce activity remained strong. Auto dealers decline in RevPAR during 2020. The properties in this

OCC

Δ ADR

ADR

REVPAR

Δ OCC

See use and distribution restrictions on the last page of this report. Downloaded by Matthew Nuss, asdf

Δ REVPAR

YEAR

Upper-Priced Penetration vs. Market Total

noted sales declined since the previous report. Tourism and category experienced a 63.8% drop in occupancy and a 18.5% TOP BRANDS

130

$235.72

-

-

80.1%

2016

$188.93

-

hospitality activity softened. Residential real estate demand decrease in ADR. Middle-priced hotels saw their RevPAR Omni (800 rms)

4.1%

5.1%

0.9%

$245.49

$198.58

remained strong, but challenges in commercial real e 80.9% decline by 61.3% during the year, while lower-priced 120 Renaissance (673 rms)

2017state

1.2%

-0.4%

$249.53

1.6%

$201.04

markets persisted. Overall manufacturing activity rose 80.6% properties experienced a RevPAR fall of 36.7%. 110 Grand Hyatt (591 rms)

2018

moderately. Banking conditions remained stable, but some 1.8% $247.62 -0.8% $203.08 1.0% JW Marriott (533 rms)

2019

82.0% Moving into 2021, Nashville RevPAR is expected to grow

100

contacts noted an uptick in delinquencies, mostly with 28.9% 45.1%. By year-end 2021, Nashville RevPAR will still be 45.0% Sheraton Hotel (482 rms)

$54.61 -73.1%

2020

-64.8%

$189.23 -23.6%

residential mortgages. less than the 2019 RevPAR level. RevPAR for Nashville hotels Westin (456 rms)

90

2016

Travel and tourism activity softened since the previous is not expected to surpass 2019 levels until 2024. For the 2017 2018 2019 2020

report. Contacts noted that properties affected by recent year, occupancy is forecast to grow by 44.6%, while average Occ ADR RevPAR

Source: Kalibri Labs, Q4 2020

Market

hurricanes, primarily in Alabama, had not completed repairs room rates are projected to increase 0.3%.

Mid-Priced Hotels Performance

as quickly as anticipated, which led to canceled reservations. Δ OCC ADR Δ ADR REVPAR Δ REVPAR Mid-Priced Penetration vs. Market Total TOP BRANDS

OCC

YEAR

Drive-to destinations across the District continued to

85.5%

2016

experience solid activity; however, some contacts anticipate - $201.31 - $172.17 - Holiday Inn (527 rms)

85.8%

2017

that surges in COVID-19 cases would dampen demand in the 0.3% $207.90 3.3% $178.34 3.6% Courtyard (418 rms)

near term..” 2018 85.4% -0.4% $208.90 0.5% $178.41 0.0% 120 Hyatt House (418 rms)

2019 82.0% -3.9% $209.77 0.4% $172.11 -3.5% Hilton Garden Inn (408 rms)

Federal Reserve Bank Beige Book, January 2021 2020 Annual Change in RevPAR

2020 37.7% -54.0% $137.80 -34.3% $51.98 -69.8% Holiday Inn Express (397 rms)

70 Drury Plaza Hotel (389 rms)

2016 2017 2018 2019 2020

All Hotels Upper-Priced Mid-Priced Lower-Priced

Source: Kalibri Labs, Q4 2020 Market Occ ADR RevPAR

Nashville: Next 4 Quarters Lower-Priced Hotels Performance

The arrows show the forecast direction of change over the next 4 quarters vs. the

YEAR

previous 4 quarters. Green indicates the change will be above the long run average, OCC Δ OCC ADR Δ ADR REVPAR Δ REVPAR Lower-Priced Penetration vs. Market Total TOP BRANDS

2016

185

yellow indicates it will be the same, and orange indicates it will be below. 74.5% - $100.55 - $74.87 - -36.7% Tru by Hilton (116 rms)

2017 71.4% -4.1% $108.28 7.7% $77.35 3.3% Extended Stay America (114 rms)

Occupancy 2018 71.5% 0.1% $116.52 7.6% $83.29 7.7% Candlewood Suites (101 rms)

Occupancy will increase to 58.1%, better than the previous 4 quarters' 2019 71.9% 0.6% -62.1% $119.35 2.4% $85.85 -61.3% 3.1% 135 Scottish Inn (77 rms)

rate of 40.2%, but below the long run average of 66.1% 2020 50.5% -29.9% $85.46 -28.4% $43.12 -49.8%

-70.5%

85

2016

Average Daily Rate Source: Kalibri Labs, Q4 2020 2017 2018 2019 2020

ADR growth expectations are increasing, positive 0.3% vs. the past 4 Annual Performance - Five Year History and Forecast Market Occ ADR RevPAR

Source: Kalibri Labs, Q4 2020

quarters' rate of negative 30.1%, but are below the long run average of YEAR OCC Δ OCC ADR Δ ADR REVPAR Δ REVPAR

positive 1.7% Downtown Nashville Construction Pipeline 2.4% $139.92 6.0% $106.90 8.5%

76.4%

2016

Revenue Per Available Room 2017 75.9% UPPER-PRICED $147.58 5.5% MID-PRICED 4.7% LOWER-PRICED UNCLASSIFIED/INDEPENDENT

$111.97

-0.7%

RevPAR growth projections are climbing to 45.1% as compared to the PHASE 2018 74.1% -2.4% $152.19 Props $112.73 0.7% Props Rooms %SubMkt Props Rooms %SubMkt

%SubMkt 3.1%

Rooms %SubMkt

Props

Rooms

past 4 quarters' rate of negative 62.1%, and are greater than the long Planning 2019 74.2% 4 0.1% 430 $153.09 0.6% 6 $113.54 6.0% 7 1,248 8.2% 8 1,232 8.1%

0.7%

907

2.8%

run average of positive 1.1% Final Planning/Bidding 2020 40.2% 4 -45.8% 720 $107.07 -30.1% 4 $43.05 -62.1% 4 745 4.9% 0 0 0.0%

3.4%

515

4.7%

Supply (orange indicates above long-term average) Underway 2021F 58.1% 4 44.6% 1,325 $107.43 0.3% 3 $62.45 425 45.1% 1 215 1.4% 1 45 0.3%

8.7%

2.8%

Supply growth is less active, 5.4% vs. the past 4 quarters' rate of 6.1%, 2022F 68.4% 17.7% $124.89 16.3% 13 $85.49 12.2% 12 2,208 14.6% 9 1,277 8.4%

36.9%

TOTAL

12

1,847

16.3%

2,475

though it is greater than the long run average of 2.3% Source: Dodge, CBRE Hotels Research, Q4 2020 6.8% $142.64 14.2% $104.30 22.0%

2023F

73.1%

2024F 74.6% 2.0% $154.94 8.6% $115.51 10.7%

Demand 2025F 74.2% -0.5% $163.43 5.5% $121.18 4.9%

Forecast demand growth is climbing, positive 52.4% vs. the past 4 Long Run Averages 2000 to 2020 P. 13 / CBRE HOTELS RESEARCH

quarters' rate of negative 42.5%, and is greater than the long run 129

HO TEL ZAZA + ZAZA HO SPIT ALITY | 20 21 MARCH YTD

average of positive 0.8% Occupancy: 66.1%, ADR Change: 1.7%, RevPAR Change: 1.1%

Source: CBRE Hotels Research, Kalibri Labs, Q4 2020