Page 48 - Microsoft Word - Hot Shots CIM Version 1.9.2 Final

P. 48

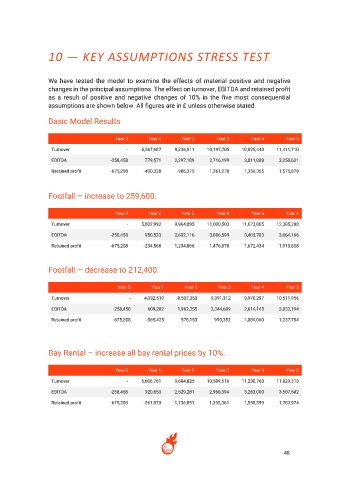

10 — KEY ASSUMPTIONS STRESS TEST

We have tested the model to examine the effects of material positive and negative

changes in the principal assumptions. The effect on turnover, EBITDA and retained profit

as a result of positive and negative changes of 10% in the five most consequential

assumptions are shown below. All figures are in £ unless otherwise stated.

Basic Model Results

Year 0 Year 1 Year 2 Year 3 Year 4 Year 5

Turnover - 5,367,687 9,236,511 10,197,705 10,825,440 11,411,710

EBITDA -258,458 779,571 2,297,109 2,716,199 3,011,088 3,250,631

Retained profit -675,208 -400,328 906,375 1,261,270 1,354,355 1,575,879

Footfall – increase to 259,600.

Year 0 Year 1 Year 2 Year 3 Year 4 Year 5

Turnover - 5,802,992 9,964,895 11,000,503 11,673,085 12,305,208

EBITDA -258,458 950,523 2,632,116 3,086,599 3,403,783 3,664,166

Retained profit -675,208 -234,568 1,234,866 1,476,870 1,672,434 1,910,838

Footfall – decrease to 212,400.

Year 0 Year 1 Year 2 Year 3 Year 4 Year 5

Turnover - 4,932,519 8,507,353 9,391,312 9,970,297 10,511,956

EBITDA -258,458 609,282 1,962,355 2,344,689 2,614,145 2,833,194

Retained profit -675,208 -565,425 578,153 993,352 1,084,060 1,237,754

Bay Rental – increase all bay rental prices by 10%.

Year 0 Year 1 Year 2 Year 3 Year 4 Year 5

Turnover - 5,606,761 9,604,825 10,589,516 11,230,763 11,829,313

EBITDA -258,458 920,653 2,529,281 2,960,394 3,263,000 3,507,542

Retained profit -675,208 -261,970 1,136,051 1,393,361 1,558,399 1,783,974

48