Page 4 - MEOG Week 38 2022

P. 4

MEOG COMMENTARY MEOG

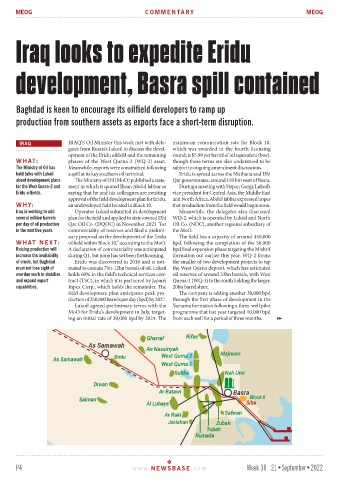

Iraq looks to expedite Eridu

development, Basra spill contained

Baghdad is keen to encourage its oilfield developers to ramp up

production from southern assets as exports face a short-term disruption.

IRAQ IRAQ’S Oil Minister this week met with dele- maximum remuneration rate for Block 10,

gates from Russia’s Lukoil to discuss the devel- which was awarded in the fourth licensing

opment of the Eridu oilfield and the remaining round, is $5.99 per barrel of oil equivalent (boe),

WHAT: phases of the West Qurna-2 (WQ-2) asset. though these terms are also understood to be

The Ministry of Oil has Meanwhile, exports were constrained following subject to ongoing amendment discussions.

held talks with Lukoil a spill at its key southern oil terminal. Eridu is spread across the Muthana and Dhi

about development plans The Ministry of Oil (MoO) published a state- Qar governorates, around 150 km west of Basra.

for the West Qurna-2 and ment in which it quoted Ihsan Abdul Jabbar as During a meeting with Stepan Gorgi, Lukoil’s

Eridu oilfields. saying that he and his colleagues are awaiting vice president for Central Asia, the Middle East

approval of the field development plan for Eridu, and North Africa, Abdul Jabbar expressed hopes

WHY: an undeveloped field located in Block 10. that production from the field would begin soon.

Iraq is working to add Operator Lukoil submitted its development Meanwhile, the delegates also discussed

several million barrels plan for the field and applied to state-owned Dhi WQ-2, which is operated by Lukoil and North

per day of oil production Qar Oil Co. (DQOC) in November 2021 “for Oil Co. (NOC), another regional subsidiary of

in the next five years. commerciality of reserves and filed a prelimi- the MoO.

nary proposal on the development of the Eridu The field has a capacity of around 450,000

WHAT NEXT: oilfield within Block 10,” according to the MoO. bpd, following the completion of the 50,000

Raising production will A declaration of commerciality was anticipated bpd final expansion phase targeting the Mishrif

increase the availability during Q1, but none has yet been forthcoming. formation out earlier this year. WQ-2 forms

of crude, but Baghdad Eridu was discovered in 2016 and is esti- the smaller of two development projects to tap

must not lose sight of mated to contain 7bn-12bn barrels of oil. Lukoil the West Qurna deposit, which has estimated

overdue work to stabilise holds 60% in the field’s technical services con- oil reserves of around 33bn barrels, with West

and expand export tract (TSC), in which it is partnered by Japan’s Qurna-1 (WQ-1) to the south holding the larger,

capabilities. Inpex Corp., which holds the remainder. The 20bn barrel share.

field development plan anticipates peak pro- The company is adding another 30,000 bpd

duction of 250,000 barrels per day (bpd) by 2027. through the first phase of development in the

Lukoil agreed preliminary terms with the Yamama formation following a three-well pilot

MoO for Eridu’s development in July, target- programme that last year targeted 10,000 bpd

ing an initial rate of 30,000 bpd by 2024. The from each well for a period of three months.

P4 www. NEWSBASE .com Week 38 21•September•2022