Page 11 - AsianOil Annual Review 2021

P. 11

AsianOil APRIL AsianOil

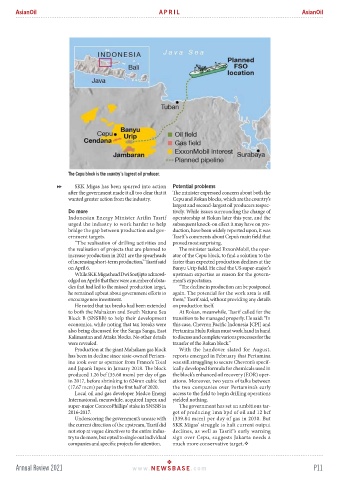

The Cepu block is the country’s lagrest oil producer.

SKK Migas has been spurred into action Potential problems

after the government made it all too clear that it The minister expressed concern about both the

wanted greater action from the industry. Cepu and Rokan blocks, which are the country’s

largest and second-largest oil producers respec-

Do more tively. While issues surrounding the change of

Indonesian Energy Minister Arifin Tasrif operatorship at Rokan later this year, and the

urged the industry to work harder to help subsequent knock-on effect it may have on pro-

bridge the gap between production and gov- duction, have been widely reported upon, it was

ernment targets. Tasrif’s comments about Cepu’s main field that

“The realisation of drilling activities and proved most surprising.

the realisation of projects that are planned to The minister tasked ExxonMobil, the oper-

increase production in 2021 are the spearheads ator of the Cepu block, to find a solution to the

of increasing short-term production,” Tasrif said faster than expected production declines at the

on April 6. Banyu Urip field. He cited the US super-major’s

While SKK Migas head Dwi Soetjipto acknowl- upstream expertise as reason for the govern-

edged on April 6 that there were a number of obsta- ment’s expectation.

cles that had led to the missed production target, “The decline in production can be postponed

he remained upbeat about government efforts to again. The potential for the work area is still

encourage new investment. there,” Tasrif said, without providing any details

He noted that tax breaks had been extended on production itself.

to both the Mahakam and South Natuna Sea At Rokan, meanwhile, Tasrif called for the

Block B (SNSBB) to help their development transition to be managed properly. He said: “In

economics, while noting that tax breaks were this case, Chevron Pacific Indonesia [CPI] and

also being discussed for the Sanga Sanga, East Pertamina Hulu Rokan must work hand in hand

Kalimantan and Attaka blocks. No other details to discuss and complete various processes for the

were revealed. transfer of the Rokan block.”

Production at the giant Mahakam gas block With the handover slated for August,

has been in decline since state-owned Pertam- reports emerged in February that Pertamina

ina took over as operator from France’s Total was still struggling to secure Chevron’s specif-

and Japan’s Inpex in January 2018. The block ically developed formula for chemicals used in

produced 1.26 bcf (35.68 mcm) per day of gas the block’s enhanced oil recovery (EOR) oper-

in 2017, before shrinking to 624mn cubic feet ations. Moreover, two years of talks between

(17.67 mcm) per day in the first half of 2020. the two companies over Pertamina’s early

Local oil and gas developer Medco Energi access to the field to begin drilling operations

Internasional, meanwhile, acquired Inpex and yielded nothing.

super-major ConocoPhillips’ stake in SNSBB in The government has set an ambitious tar-

2016-2017. get of producing 1mn bpd of oil and 12 bcf

Underscoring the government’s unease with (339.84 mcm) per day of gas in 2030. But

the current direction of the upstream, Tasrif did SKK Migas’ struggle to halt current output

not stop at vague directives to the entire indus- declines, as well as Tasrif ’s early warning

try to do more, but opted to single out individual sign over Cepu, suggests Jakarta needs a

companies and specific projects for attention. much more conservative target.

Annual Review 2021 www. NEWSBASE .com P11