Page 9 - FSUOGM Week 25 2021

P. 9

FSUOGM COMMENTARY FSUOGM

Lukoil’s oil sands fields to languish

under current tax regime: Rystad

Russia's decision to abolish tax relief starting this year has been tough on

producers of high-viscous oil. Lukoil operates two large fields of this kind in

the Komi region, writes Rystad Energy

RUSSIA RUSSIA’S decision to abolish tax reliefs start- millipascal-seconds (mPa·s), which means it can

ing this year has been tough on producers of be classified as oil sands. The field itself consists

high-viscous oil. Lukoil has become the second of two main structures – Yaregskaya and Lyayel-

victim of the new tax rules, after Tatneft, as it skaya. The first structure has been developed

operates two large high-viscous fields in the since 1932 with mining techniques and thermal

Komi republic – Yaregskoye and Usinskoye. On steam treatment methods, which brought quite

top of this, the company has lost export duty stable oil production during the past decade.

incentives for its Korchagin field in the Cas- Since 2012, the Lyayelskaya structure has been

pian Sea. Even so, Lukoil continues to expand developed as an expansion project using the

production at these fields through drilling pro- steam-assisted gravity drainage (SAGD) tech-

grammes in the hope that the tax incentives may nology widely used in Canada, and is now the

be brought back if negotiations with the author- main contributor to the field’s oil sands produc-

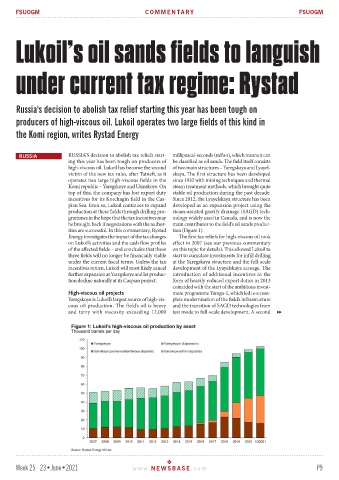

ities are successful. In this commentary, Rystad tion (Figure 1).

Energy investigates the impact of the tax changes The first tax reliefs for high-viscous oil took

on Lukoil’s activities and the cash flow profiles effect in 2007 (see our previous commentary

of the affected fields – and concludes that these on this topic for details). This allowed Lukoil to

three fields will no longer be financially viable start to cumulate investments for infill drilling

under the current fiscal terms. Unless the tax at the Yaregskaya structure and the full-scale

incentives return, Lukoil will most likely cancel development of the Lyayelskaya acreage. The

further expansion at Yaregskoye and let produc- introduction of additional incentives in the

tion decline naturally at its Caspian project. form of heavily reduced export duties in 2013

coincided with the start of the ambitious invest-

High-viscous oil projects ment programme Yarega-1, which led to a com-

Yaregskoye is Lukoil’s largest source of high-vis- plete modernisation of the field’s infrastructure

cous oil production. The field’s oil is heavy and the transition of SAGD technologies from

and tarry with viscosity exceeding 12,000 test mode to full-scale development. A second

Week 25 23•June•2021 www. NEWSBASE .com P9