Page 5 - DMEA Week 47 2021

P. 5

DMEA COMMENTARY DMEA

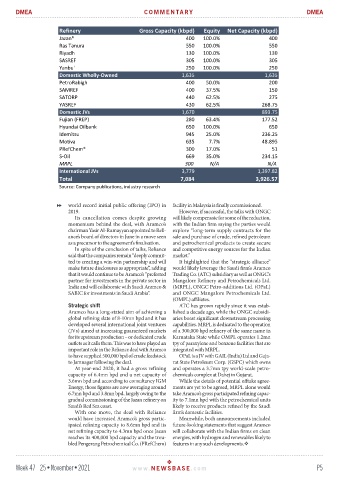

Refinery Gross Capacity (kbpd) Equity Net Capacity (kbpd)

Jazan* 400 100.0% 400

Ras Tanura 550 100.0% 550

Riyadh 130 100.0% 130

SASREF 305 100.0% 305

Yanbu' 250 100.0% 250

Domestic Wholly-Owned 1,635 1,635

PetroRabigh 400 50.0% 200

SAMREF 400 37.5% 150

SATORP 440 62.5% 275

YASREF 430 62.5% 268.75

Domestic JVs 1,670 893.75

Fujian (FREP) 280 63.4% 177.52

Hyundai Oilbank 650 100.0% 650

Idemitsu 945 25.0% 236.25

Motiva 635 7.7% 48.895

PRefChem* 300 17.0% 51

S-Oil 669 35.0% 234.15

MRPL 300 N/A N/A

International JVs 3,779 1,397.82

Total 7,084 3,926.57

Source: Company publications, industry research

world record initial public offering (IPO) in facility in Malaysia is finally commissioned.

2019. However, if successful, the talks with ONGC

Its cancellation comes despite growing will likely compensate for some of the reduction,

momentum behind the deal, with Aramco’s with the Indian firm saying the parties would

chairman Yasir Al-Rumayyan appointed to Reli- explore “long-term supply contracts for the

ance’s board of directors in June in a move seen sale and purchase of crude, refined petroleum

as a precursor to the agreement’s finalisation. and petrochemical products to create secure

In spite of the conclusion of talks, Reliance and competitive energy sources for the Indian

said that the companies remain “deeply commit- market.”

ted to creating a win-win partnership and will It highlighted that the “strategic alliance”

make future disclosures as appropriate”, adding would likely leverage the Saudi firm’s Aramco

that it would continue to be Aramco’s “preferred Trading Co. (ATC) subsidiary as well as ONGC’s

partner for investments in the private sector in Mangalore Refinery and Petrochemicals Ltd.

India and will collaborate with Saudi Aramco & (MRPL), ONGC Petro-additions Ltd. (OPaL)

SABIC for investments in Saudi Arabia”. and ONGC Mangalore Petrochemicals Ltd.

(OMPL) affiliates.

Strategic shift ATC has grown rapidly since it was estab-

Aramco has a long-stated aim of achieving a lished a decade ago, while the ONGC subsidi-

global refining slate of 8-10mn bpd and it has aries boast significant downstream processing

developed several international joint ventures capabilities. MRPL is dedicated to the operation

(JVs) aimed at increasing guaranteed markets of a 300,000 bpd refinery of the same name in

for its upstream production – or dedicated crude Karnataka State while OMPL operates 1.2mn

outlets as it calls them. This was to have played an tpy of paraxylene and benzene facilities that are

important role in the Reliance deal with Aramco integrated with MRPL.

to have supplied 500,000 bpd of crude feedstock OPaL is a JV with GAIL (India) Ltd and Guja-

to Jamnagar following the deal. rat State Petroleum Corp. (GSPC) which owns

At year-end 2020, it had a gross refining and operates a 3.7mn tpy world-scale petro-

capacity of 6.4mn bpd and a net capacity of chemicals complex at Dahej in Gujarat.

3.6mn bpd and according to consultancy IGM While the details of potential offtake agree-

Energy, those figures are now averaging around ments are yet to be agreed, MRPL alone would

6.7mn bpd and 3.8mn bpd, largely owing to the take Aramco’s gross participated refining capac-

gradual commissioning of the Jazan refinery on ity to 7.1mn bpd with the petrochemical units

Saudi’s Red Sea coast. likely to receive products refined by the Saudi

With one move, the deal with Reliance firm’s domestic facilities.

would have increased Aramco’s gross partic- Meanwhile, both announcements included

ipated refining capacity to 8.6mn bpd and its future-looking statements that suggest Aramco

net refining capacity to 4.3mn bpd once Jazan will collaborate with the Indian firms on clean

reaches its 400,000 bpd capacity and the trou- energies, with hydrogen and renewables likely to

bled Pengerang Petrochemical Co. (PRefChem) features in any such developments.

Week 47 25•November•2021 www. NEWSBASE .com P5