Page 7 - DMEA Week 47 2021

P. 7

DMEA COMMENTARY DMEA

Morocco’s gas supply woes

Against the backdrop of tight gas markets in Europe, Morocco

has lost access to gas from Algeria, its main supplier.

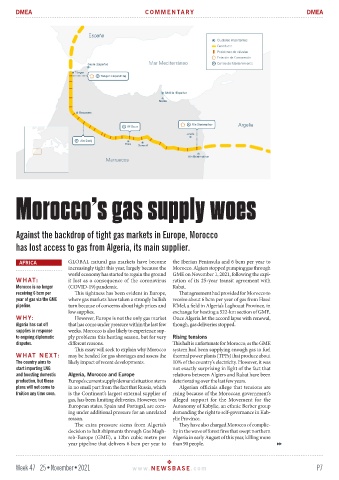

AFRICA GLOBAL natural gas markets have become the Iberian Peninsula and 6 bcm per year to

increasingly tight this year, largely because the Morocco. Algiers stopped pumping gas through

world economy has started to regain the ground GME on November 1, 2021, following the expi-

WHAT: it lost as a consequence of the coronavirus ration of its 25-year transit agreement with

Morocco is no longer (COVID-19) pandemic. Rabat.

receiving 6 bcm per This tightness has been evident in Europe, That agreement had provided for Morocco to

year of gas via the GME where gas markets have taken a strongly bullish receive about 6 bcm per year of gas from Hassi

pipeline. turn because of concerns about high prices and R’Mel, a field in Algeria’s Laghouat Province, in

low supplies. exchange for hosting a 522-km section of GME.

WHY: However, Europe is not the only gas market Once Algeria let the accord lapse with renewal,

Algeria has cut off that has come under pressure within the last few though, gas deliveries stopped.

supplies in response weeks. Morocco is also likely to experience sup-

to ongoing diplomatic ply problems this heating season, but for very Rising tensions

disputes. different reasons. This halt is unfortunate for Morocco, as the GME

This essay will seek to explain why Morocco system had been supplying enough gas to fuel

WHAT NEXT: may be headed for gas shortages and assess the thermal power plants (TPPs) that produce about

The country aims to likely impact of recent developments. 10% of the country’s electricity. However, it was

start importing LNG not exactly surprising in light of the fact that

and boosting domestic Algeria, Morocco and Europe relations between Algiers and Rabat have been

production, but these Europe’s current supply/demand situation stems deteriorating over the last few years.

plans will not come to in no small part from the fact that Russia, which Algerian officials allege that tensions are

fruition any time soon. is the Continent’s largest external supplier of rising because of the Moroccan government’s

gas, has been limiting deliveries. However, two alleged support for the Movement for the

European states, Spain and Portugal, are com- Autonomy of Kabylie, an ethnic Berber group

ing under additional pressure for an unrelated demanding the right to self-governance in Kab-

reason. ylie Province.

The extra pressure stems from Algeria’s They have also charged Morocco of complic-

decision to halt shipments through Gas Magh- ity in the wave of forest fires that swept northern

reb-Europe (GME), a 12bn cubic metre per Algeria in early August of this year, killing more

year pipeline that delivers 6 bcm per year to than 90 people.

Week 47 25•November•2021 www. NEWSBASE .com P7