Page 106 - SE Outlook Regions 2022

P. 106

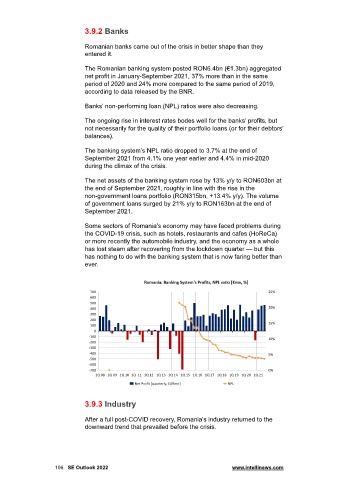

3.9.2 Banks

Romanian banks came out of the crisis in better shape than they

entered it.

The Romanian banking system posted RON6.4bn (€1.3bn) aggregated

net profit in January-September 2021, 37% more than in the same

period of 2020 and 24% more compared to the same period of 2019,

according to data released by the BNR.

Banks’ non-performing loan (NPL) ratios were also decreasing.

The ongoing rise in interest rates bodes well for the banks’ profits, but

not necessarily for the quality of their portfolio loans (or for their debtors’

balances).

The banking system’s NPL ratio dropped to 3.7% at the end of

September 2021 from 4.1% one year earlier and 4.4% in mid-2020

during the climax of the crisis.

The net assets of the banking system rose by 13% y/y to RON603bn at

the end of September 2021, roughly in line with the rise in the

non-government loans portfolio (RON315bn, +13.4% y/y). The volume

of government loans surged by 21% y/y to RON163bn at the end of

September 2021.

Some sectors of Romania’s economy may have faced problems during

the COVID-19 crisis, such as hotels, restaurants and cafes (HoReCa)

or more recently the automobile industry, and the economy as a whole

has lost steam after recovering from the lockdown quarter — but this

has nothing to do with the banking system that is now faring better than

ever.

3.9.3 Industry

After a full post-COVID recovery, Romania’s industry returned to the

downward trend that prevailed before the crisis.

106 SE Outlook 2022 www.intellinews.com