Page 109 - SE Outlook Regions 2022

P. 109

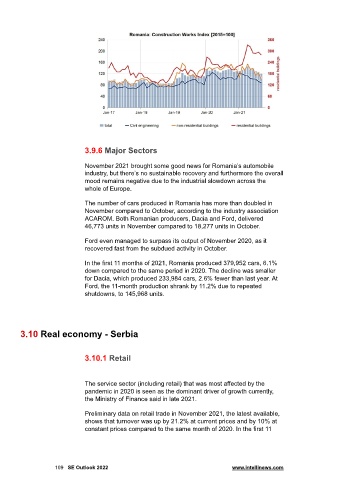

3.9.6 Major Sectors

November 2021 brought some good news for Romania’s automobile

industry, but there’s no sustainable recovery and furthermore the overall

mood remains negative due to the industrial slowdown across the

whole of Europe.

The number of cars produced in Romania has more than doubled in

November compared to October, according to the industry association

ACAROM. Both Romanian producers, Dacia and Ford, delivered

46,773 units in November compared to 18,277 units in October.

Ford even managed to surpass its output of November 2020, as it

recovered fast from the subdued activity in October.

In the first 11 months of 2021, Romania produced 379,952 cars, 6.1%

down compared to the same period in 2020. The decline was smaller

for Dacia, which produced 233,984 cars, 2.6% fewer than last year. At

Ford, the 11-month production shrank by 11.2% due to repeated

shutdowns, to 145,968 units.

3.10 Real economy - Serbia

3.10.1 Retail

The service sector (including retail) that was most affected by the

pandemic in 2020 is seen as the dominant driver of growth currently,

the Ministry of Finance said in late 2021.

Preliminary data on retail trade in November 2021, the latest available,

shows that turnover was up by 21.2% at current prices and by 10% at

constant prices compared to the same month of 2020. In the first 11

109 SE Outlook 2022 www.intellinews.com