Page 107 - SE Outlook Regions 2022

P. 107

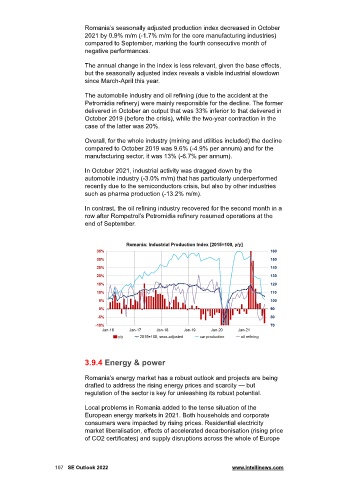

Romania’s seasonally adjusted production index decreased in October

2021 by 0.9% m/m (-1.7% m/m for the core manufacturing industries)

compared to September, marking the fourth consecutive month of

negative performances.

The annual change in the index is less relevant, given the base effects,

but the seasonally adjusted index reveals a visible industrial slowdown

since March-April this year.

The automobile industry and oil refining (due to the accident at the

Petromidia refinery) were mainly responsible for the decline. The former

delivered in October an output that was 33% inferior to that delivered in

October 2019 (before the crisis), while the two-year contraction in the

case of the latter was 20%.

Overall, for the whole industry (mining and utilities included) the decline

compared to October 2019 was 9.6% (-4.9% per annum) and for the

manufacturing sector, it was 13% (-6.7% per annum).

In October 2021, industrial activity was dragged down by the

automobile industry (-3.0% m/m) that has particularly underperformed

recently due to the semiconductors crisis, but also by other industries

such as pharma production (-13.2% m/m).

In contrast, the oil refining industry recovered for the second month in a

row after Rompetrol’s Petromidia refinery resumed operations at the

end of September.

3.9.4 Energy & power

Romania’s energy market has a robust outlook and projects are being

drafted to address the rising energy prices and scarcity — but

regulation of the sector is key for unleashing its robust potential.

Local problems in Romania added to the tense situation of the

European energy markets in 2021. Both households and corporate

consumers were impacted by rising prices. Residential electricity

market liberalisation, effects of accelerated decarbonisation (rising price

of CO2 certificates) and supply disruptions across the whole of Europe

107 SE Outlook 2022 www.intellinews.com