Page 13 - LatAmOil Week 19 2021

P. 13

LatAmOil PERU LatAmOil

It also reported that it had spudded 3WD on and CEO of PetroTal, expressed satisfaction

May 3 and expected to finish drilling and com- with the production forecast for the field.

plete the well in about 41 days. Finishing this “It is very exciting as a management team to

well will enable PetroTal to dispose of another be bringing the new 7D well on for the company

50,000 bpd of water, enough to accommodate after almost a year lag from completion of the

anticipated production growth for the next 14 6H well,” he said. “The stabilised flow rates of

months, it said. approximately 4,550 bpd look very promising

The Bretaña oilfield lies within Block 95, and are in line with our technical estimates.

a licence area within Peru’s northern Loreto Continuing with our development plan, we

region. commenced drilling the 3WD well, [which] will

Manuel Pablo Zuniga-Pflucker, the president greatly increase our water disposal capacity.”

ARGENTINA

TGS blames government’s gas

price freeze for losses in Q1-2021

TRANSPORTADORA de Gas del Sur (TGS), mid-term elections scheduled for November of

Argentina’s largest transporter of natural gas, this year, the newspaper added.

has blamed the government for its poor finan- It also noted, though, that the government

cial performance in the first quarter of the year. was likely to let downstream gas prices climb in

Alejandro Basso, the CFO of TGS, said dur- the near future, as it has already done for elec-

ing an earnings call earlier this week that the tricity distributors.

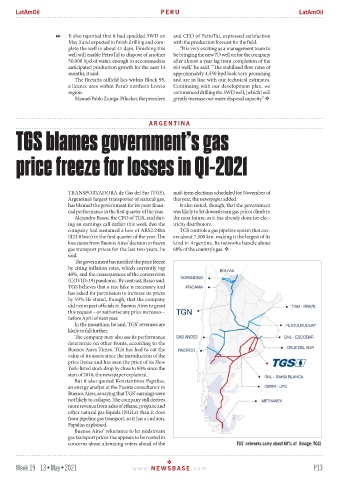

company had sustained a loss of ARS2.24bn TGS controls a gas pipeline system that cov-

($23.83mn) in the first quarter of the year. The ers about 7,500 km, making it the largest of its

loss stems from Buenos Aires’ decision to freeze kind in Argentina. Its networks handle about

gas transport prices for the last two years, he 60% of the country’s gas.

said.

The government has justified the price freeze

by citing inflation rates, which currently top

40%, and the consequences of the coronavirus

(COVID-19) pandemic. By contrast, Basso said,

TGS believes that a rate hike is necessary and

has asked for permission to increase its prices

by 59%.He stated, though, that the company

did not expect officials in Buenos Aires to grant

this request – or authorise any price increases –

before April of next year.

In the meantime, he said, TGS’ revenues are

likely to fall further.

The company may also see its performance

deteriorate on other fronts, according to the

Buenos Aires Times. TGS has had to cut the

value of its assets since the introduction of the

price freeze and has seen the price of its New

York-listed stock drop by close to 80% since the

start of 2018, the newspaper explained.

But it also quoted Konstantinos Papalias,

an energy analyst at the Puente consultancy in

Buenos Aires, as saying that TGS’ earnings were

not likely to collapse. The company still derives

more revenue from sales of ethane, propane and

other natural gas liquids (NGLs) than it does

from pipeline gas transport, so it has a cushion,

Papalias explained.

Buenos Aires’ reluctance to let midstream

gas transport prices rise appears to be rooted in

concerns about alienating voters ahead of the TGS’ networks carry about 60% of (Image: TGS)

Week 19 13•May•2021 www. NEWSBASE .com P13