Page 13 - LatAmOil Week 14 2021

P. 13

LatAmOil ARGENTINA LatAmOil

Fernandez characterised the measure as justi- combination with a decline in energy demand,

fied, saying: “We want to protect those who put caused crude output to sink from about 520,000

their trust in Argentina, invest in Argentina and barrels per day in March 2020 to 445,614 bpd in

earn in Argentina, and then need to pay the lia- May 2020, a fall of 14.305% in just two months.

bilities that they took on abroad.” Yields have recovered somewhat. Accord-

Argentina’s government has been trying to ing to official data from Argentina’s Secretariat

encourage oil operators to raise production. of Energy, the South American state produced

The country’s output levels dropped last year 492,040 bpd of oil in February 2021. Meanwhile,

as a result of the coronavirus (COVID-19) Daniel Dreizzen, a former national secretary of

pandemic, which led Buenos Aires to impose energy planning, was quoted as saying in late

a strict lockdown regime between March and March that he expected output levels to climb

November. These public health measures, in back to 520,000 bpd by the end of this year.

PERU

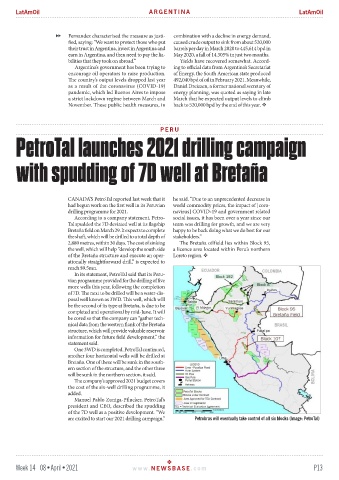

PetroTal launches 2021 drilling campaign

with spudding of 7D well at Bretaña

CANADA’S PetroTal reported last week that it he said. “Due to an unprecedented decrease in

had begun work on the first well in its Peruvian world commodity prices, the impact of [coro-

drilling programme for 2021. navirus] COVID-19 and government related

According to a company statement, Petro- social issues, it has been over a year since our

Tal spudded the 7D deviated well at its flagship team was drilling for growth, and we are very

Bretaña field on March 29. It expects to complete happy to be back doing what we do best for our

the shaft, which will be drilled to a total depth of stakeholders.”

2,880 metres, within 30 days. The cost of sinking The Bretaña oilfield lies within Block 95,

the well, which will help “develop the south side a licence area located within Peru’s northern

of the Bretaña structure and execute an oper- Loreto region.

ationally straightforward drill,” is expected to

reach $9.5mn.

In its statement, PetroTal said that its Peru-

vian programme provided for the drilling of five

more wells this year, following the completion

of 7D. The next to be drilled will be a water-dis-

posal well known as 3WD. This well, which will

be the second of its type at Bretaña, is due to be

completed and operational by mid-June. It will

be cored so that the company can “gather tech-

nical data from the western flank of the Bretaña

structure, which will provide valuable reservoir

information for future field development,” the

statement said.

One 3WD is completed, PetroTal continued,

another four horizontal wells will be drilled at

Bretaña. One of these will be sunk in the south-

ern section of the structure, and the other three

will be sunk in the northern section, it said.

The company’s approved 2021 budget covers

the cost of the six-well drilling programme, it

added.

Manuel Pablo Zuniga-Pflucker, PetroTal’s

president and CEO, described the spudding

of the 7D well as a positive development. “We

are excited to start our 2021 drilling campaign,” Petrobras will eventually take control of all six blocks (Image: PetroTal)

Week 14 08•April•2021 www. NEWSBASE .com P13