Page 5 - EurOil Week 03 2023

P. 5

EurOil COMMENTARY EurOil

than half of these production curtailments. demand there. Asian LNG imports fell by 7%

According to the International Fertiliser Asso- in 2022, after China’s imports dropped around

ciation, around 70% of the EU’s ammonia pro- 20%, or 20 bcm, freeing more LNG for export

duction capacity was offline in August 2022 and to Europe.

around 40% had still not restarted in October This year as China phases out its no-COVID

2022,” the IEA said in its report. “There have also restrictions its economy is expected to bounce

been production curtailments in the steel and back and the global LNG market is anticipated

aluminium sectors, where high gas and electric- to be a lot tighter as a result.

ity prices led to a 10% drop in production in the “If China’s LNG imports recover to their

ten first months of 2022 compared with the same 2021 levels, it would capture most of the overall

period in 2021. There was also less natural gas increase in global LNG supply in 2023 and limit

consumed in cement, glass, ceramics, food and the LNG volumes available to the European mar-

machinery production, although most of this ket. Under this assumption, we estimate that the

was because of efficiency improvements and European Union could increase its LNG imports

fuel switching.” by around 7 bcm in 2023,” the IEA says, well

European policy makers want to avoid the short of the circa 30 bcm additional gas imports

same amount of pain again this year. it needs.

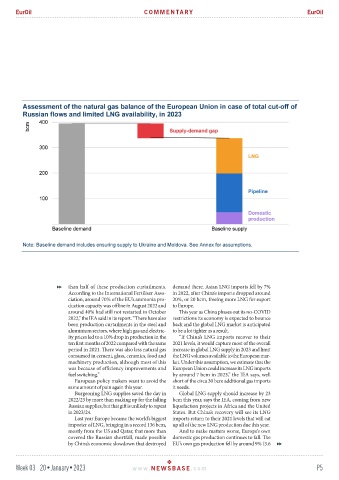

Burgeoning LNG supplies saved the day in Global LNG supply should increase by 23

2022/23 by more than making up for the falling bcm this year, says the IEA, coming from new

Russian supplies, but that gift is unlikely to repeat liquefaction projects in Africa and the United

in 2023/24. States. But China’s recovery will see its LNG

Last year Europe became the world’s biggest imports return to their 2021 levels that will eat

importer of LNG, bringing in a record 136 bcm, up all of the new LNG production due this year.

mostly from the US and Qatar, that more than And to make matters worse, Europe’s own

covered the Russian shortfall, made possible domestic gas production continues to fall. The

by China’s economic slowdown that destroyed EU’s own gas production fell by around 9% (3.6

Week 03 20•January•2023 www. NEWSBASE .com P5