Page 8 - EurOil Week 03 2023

P. 8

EurOil EurOil

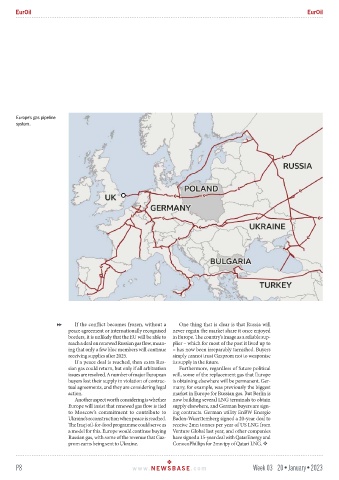

Europe's gas pipeline

system.

If the conflict becomes frozen, without a One thing that is clear is that Russia will

peace agreement or internationally recognised never regain the market share it once enjoyed

borders, it is unlikely that the EU will be able to in Europe. The country’s image as a reliable sup-

reach a deal on renewed Russian gas flow, mean- plier – which for most of the past it lived up to

ing that only a few bloc members will continue – has now been irreparably tarnished. Buyers

receiving supplies after 2025. simply cannot trust Gazprom not to weaponise

If a peace deal is reached, then extra Rus- its supply in the future.

sian gas could return, but only if all arbitration Furthermore, regardless of future political

issues are resolved. A number of major European will, some of the replacement gas that Europe

buyers lost their supply in violation of contrac- is obtaining elsewhere will be permanent. Ger-

tual agreements, and they are considering legal many, for example, was previously the biggest

action. market in Europe for Russian gas. But Berlin is

Another aspect worth considering is whether now building several LNG terminals to obtain

Europe will insist that renewed gas flow is tied supply elsewhere, and German buyers are sign-

to Moscow’s commitment to contribute to ing contracts. German utility EnBW Energie

Ukraine’s reconstruction when peace is reached. Baden-Wuerttemberg signed a 20-year deal to

The Iraqi oil-for-food programme could serve as receive 2mn tonnes per year of US LNG from

a model for this. Europe would continue buying Venture Global last year, and other companies

Russian gas, with some of the revenue that Gaz- have signed a 15-year deal with QatarEnergy and

prom earns being sent to Ukraine. ConocoPhillips for 2mn tpy of Qatari LNG.

P8 www. NEWSBASE .com Week 03 20•January•2023