Page 9 - MEOG Week 22 2021

P. 9

MEOG PROJECTS & COMPANIES MEOG

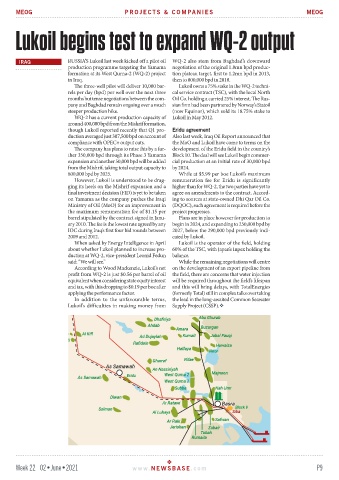

Lukoil begins test to expand WQ-2 output

IRAQ RUSSIA’S Lukoil last week kicked off a pilot oil WQ-2 also stem from Baghdad’s downward

production programme targeting the Yamama negotiation of the original 1.8mn bpd produc-

formation at its West Qurna-2 (WQ-2) project tion plateau target, first to 1.2mn bpd in 2013,

in Iraq. then to 800,000 bpd in 2018.

The three-well pilot will deliver 10,000 bar- Lukoil owns a 75% stake in the WQ-2 techni-

rels per day (bpd) per well over the next three cal service contract (TSC), with the local North

months but tense negotiations between the com- Oil Co. holding a carried 25% interest. The Rus-

pany and Baghdad remain ongoing over a much sian firm had been partnered by Norway’s Statoil

steeper production hike. (now Equinor), which sold its 18.75% stake to

WQ-2 has a current production capacity of Lukoil in May 2012.

around 400,000 bpd from the Mishrif formation,

though Lukoil reported recently that Q1 pro- Eridu agreement

duction averaged just 307,500 bpd on account of Also last week, Iraq Oil Report announced that

compliance with OPEC+ output cuts. the MoO and Lukoil have come to terms on the

The company has plans to raise this by a fur- development of the Eridu field in the country’s

ther 350,000 bpd through its Phase 3 Yamama Block 10. The deal will see Lukoil begin commer-

expansion and another 50,000 bpd will be added cial production at an initial rate of 30,000 bpd

from the Mishrif, taking total output capacity to by 2024.

800,000 bpd by 2025. While at $5.99 per boe Lukoil’s maximum

However, Lukoil is understood to be drag- remuneration fee for Eridu is significantly

ging its heels on the Mishrif expansion and a higher than for WQ-2, the two parties have yet to

final investment decision (FID) is yet to be taken agree on amendments to the contract. Accord-

on Yamama as the company pushes the Iraqi ing to sources at state-owned Dhi Qar Oil Co.

Ministry of Oil (MoO) for an improvement in (DQOC), such agreement is required before the

the maximum remuneration fee of $1.15 per project progresses.

barrel stipulated by the contract signed in Janu- Plans are in place however for production to

ary 2010. The fee is the lowest rate agreed by any begin in 2024, and expanding to 250,000 bpd by

IOC during Iraq’s first four bid rounds between 2027, below the 290,000 bpd previously indi-

2009 and 2012. cated by Lukoil.

When asked by Energy Intelligence in April Lukoil is the operator of the field, holding

about whether Lukoil planned to increase pro- 60% of the TSC, with Japan’s Inpex holding the

duction at WQ-2, vice-president Leonid Fedun balance.

said: “We will see.” While the remaining negotiations will centre

According to Wood Mackenzie, Lukoil’s net on the development of an export pipeline from

profit from WQ-2 is just $0.56 per barrel of oil the field, there are concerns that water injection

equivalent when considering state equity interest will be required throughout the field’s lifespan

and tax, with this dropping to $0.19 per boe after and this will bring delays, with TotalEnergies

applying the performance factor. (formerly Total) still in complex talks over taking

In addition to the unfavourable terms, the lead in the long-awaited Common Seawater

Lukoil’s difficulties in making money from Supply Project (CSSP).

Week 22 02•June•2021 www. NEWSBASE .com P9