Page 5 - FSUOGM Week 12 2022

P. 5

FSUOGM COMMENTARY FSUOGM

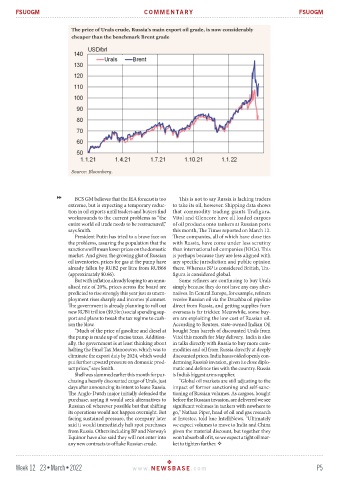

BCS GM believes that the IEA forecast is too This is not to say Russia is lacking traders

extreme, but is expecting a temporary reduc- to take its oil, however. Shipping data shows

tion in oil exports until traders and buyers find that commodity trading giants Trafigura,

workarounds to the current problems as “the Vitol and Glencore have all loaded cargoes

entire world oil trade needs to be restructured,” of oil products onto tankers at Russian ports

says Smith. this month, The Times reported on March 12.

President Putin has tried to a brave face on These companies, all of which have close ties

the problems, assuring the population that the with Russia, have come under less scrutiny

sanctions will mean lower prices on the domestic than international oil companies (IOCs). This

market. And given the growing glut of Russian is perhaps because they are less aligned with

oil inventories, prices for gas at the pump have any specific jurisdiction and public opinion

already fallen by RUB2 per litre from RUB66 there. Whereas BP is considered British, Tra-

(approximately $0.66). figura is considered global.

But with inflation already leaping to an annu- Some refiners are continuing to buy Urals

alised rate of 20%, prices across the board are simply because they do not have any easy alter-

predicted to rise strongly this year just as unem- natives. In Central Europe, for example, refiners

ployment rises sharply and incomes plummet. receive Russian oil via the Druzhba oil pipeline

The government is already planning to roll out direct from Russia, and getting supplies from

new RUB1 trillion ($9.5bn) social spending sup- overseas is far trickier. Meanwhile, some buy-

port and plans to tweak the tax regime to cush- ers are exploiting the low cost of Russian oil.

ion the blow. According to Reuters, state-owned Indian Oil

“Much of the price of gasoline and diesel at bought 3mn barrels of discounted Urals from

the pump is made up of excise taxes. Addition- Vitol this month for May delivery. India is also

ally, the government is at least thinking about in talks directly with Russia to buy more com-

halting the Final Tax Manoeuvre, which was to modities and oil from Russia directly at deeply

eliminate the export duty by 2024, which would discounted prices. India has avoided openly con-

put further upward pressure on domestic prod- demning Russia’s invasion, given its close diplo-

uct prices,” says Smith. matic and defence ties with the country. Russia

Shell was slammed earlier this month for pur- is India’s biggest arms supplier.

chasing a heavily discounted cargo of Urals, just "Global oil markets are still adjusting to the

days after announcing its intent to leave Russia. impact of former sanctioning and self-sanc-

The Anglo-Dutch major initially defended the tioning of Russian volumes. As cargoes, bought

purchase, saying it would seek alternatives to before the Russian invasion, are delivered we see

Russian oil wherever possible but that shifting significant volumes in tankers with nowhere to

its operations would not happen overnight. But go," Nathan Piper, head of oil and gas research

facing sustained pressure, the company later at Investec, told bne IntelliNews. "Ultimately

said it would immediately halt spot purchases we expect volumes to move to India and China

from Russia. Others including BP and Norway’s given the material discount, but together they

Equinor have also said they will not enter into won't absorb all of it, so we expect a tight oil mar-

any new contracts to offtake Russian crude. ket to tighten further.

Week 12 23•March•2022 www. NEWSBASE .com P5