Page 9 - FSUOGM Week 41

P. 9

FSUOGM COMMENTARY FSUOGM

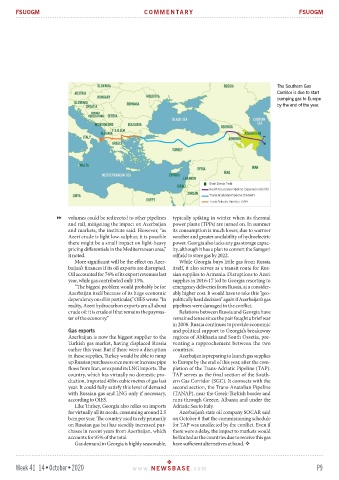

The Southern Gas

Corridor is due to start

pumping gas to Europe

by the end of the year.

volumes could be redirected to other pipelines typically spiking in winter when its thermal

and rail, mitigating the impact on Azerbaijan power plants (TPPs) are turned on. In summer

and markets, the institute said. However, “as its consumption is much lower, due to warmer

Azeri crude is light low-sulphur, it is possible weather and greater availability of hydroelectric

there might be a small impact on light-heavy power. Georgia also lacks any gas storage capac-

pricing differentials in the Mediterranean area,” ity, although it has a plan to convert the Samgori

it noted. oilfield to store gas by 2022.

More significant will be the effect on Azer- While Georgia buys little gas from Russia

baijan’s finances if its oil exports are disrupted. itself, it also serves as a transit route for Rus-

Oil accounted for 74% of its export revenues last sian supplies to Armenia. Disruptions to Azeri

year, while gas contributed only 13%. supplies in 2016-17 led to Georgia resorting to

“The biggest problem would probably be for emergency deliveries from Russia, at a consider-

Azerbaijan itself because of its huge economic ably higher cost. It would have to take this “geo-

dependency on oil in particular,” OIES wrote. “In politically hard decision” again if Azerbaijan’s gas

reality, Azeri hydrocarbon exports are all about pipelines were damaged in the conflict.

crude oil: it is crude oil that remains the paymas- Relations between Russia and Georgia have

ter of the economy.” remained tense since the pair fought a brief war

in 2008. Russia continues to provide economic

Gas exports and political support to Georgia’s breakaway

Azerbaijan is now the biggest supplier to the regions of Abkhazia and South Ossetia, pre-

Turkish gas market, having displaced Russia venting a rapprochement between the two

earlier this year. But if there were a disruption countries.

in these supplies, Turkey would be able to ramp Azerbaijan is preparing to launch gas supplies

up Russian purchases once more or increase pipe to Europe by the end of this year, after the com-

flows from Iran, or expand its LNG imports. The pletion of the Trans-Adriatic Pipeline (TAP).

country, which has virtually no domestic pro- TAP serves as the final section of the South-

duction, imported 45bn cubic metres of gas last ern Gas Corridor (SGC). It connects with the

year. It could fully satisfy this level of demand second section, the Trans-Anatolian Pipeline

with Russian gas and LNG only if necessary, (TANAP), near the Greek-Turkish border and

according to OIES. runs through Greece, Albania and under the

Like Turkey, Georgia also relies on imports Adriatic Sea to Italy.

for virtually all its needs, consuming around 2.5 Azerbaijan’s state oil company SOCAR said

bcm per year. The country used to rely primarily on October 8 that the commissioning schedule

on Russian gas but has steadily increased pur- for TAP was unaffected by the conflict. Even if

chases in recent years from Azerbaijan, which there were a delay, the impact to markets would

accounts for 95% of the total. be limited as the countries due to receive this gas

Gas demand in Georgia is highly seasonable, have sufficient alternatives at hand.

Week 41 14•October•2020 www. NEWSBASE .com P9